The week of trading in the stock market unfolded like a suspense thriller, highlighted by unpredictable turns that kept investors on edge. Just when it seemed that all was lost amid the ongoing U.S.-China trade conflicts, stocks made a notable sprint down the home stretch last Friday, reclaiming some of their earlier losses. Dismal economic indicators juxtaposed against hopeful governmental rhetoric created an environment ripe for volatility. This duality raises questions about how inextricably linked market performance is to geopolitical events—a relationship that seems to swing wildly, leaving investors disoriented in its wake.

The White House’s optimistic outlook regarding potential negotiations with China contrasted sharply with Beijing’s retaliatory tariff hikes, showcasing the political turmoil that defines today’s investment climate. Ironically, a marketplace so inherently reacting to external shocks paints a revealing picture: can we genuinely claim to have agency over our investments, or are we pawns in an increasingly complicated global chess game?

The Unpredictable Nature of Stock Performance

During this chaotic week, the S&P 500 experienced fluctuations not seen in decades. A staggering rally on Wednesday brought a bold assertion: it marked the third-largest increment in a single day since World War II. However, the elation was short-lived, with the market shedding most of those gains in a brief Thursday downturn. Investors were left attempting to navigate a tricky landscape where one day’s victory might dissolve into an abyss of uncertainty the very next.

These rapid shifts raise a critical analytic point: are we witnessing market corrections or mere reactions to sensational headlines? It’s risky to ground your beliefs firmly in either camp, as the line between organized investment strategies and sheer reactionary trading grows increasingly blurred. When economic and policy uncertainties loom large, the traditional wisdom of “buy low, sell high” becomes muddied with the question of when “low” will actually become “lower.”

The Financial Sector’s Divided Response

Within the broader markets, financial giants like Wells Fargo and BlackRock showed disparate trends, amplifying the week’s volatility. Wells Fargo reported a lackluster earnings report that led to a notable dip in its share price, reflecting the systemic struggles faced by banks in this evolving economic narrative. The less-than-expected revenues were a stark reminder that the financial sector is navigating through choppy waters as well.

In contrast, BlackRock showcased resilience, with a nearly 3% jump following its favorable quarterly earnings. This divergence begs the question: how much can individual corporate health withstand the overarching pressures of broader market trends? While the markets might surge on a wave of optimism at times, the individual stories of companies like Wells Fargo and BlackRock underscore the complexity inherent in today’s economy.

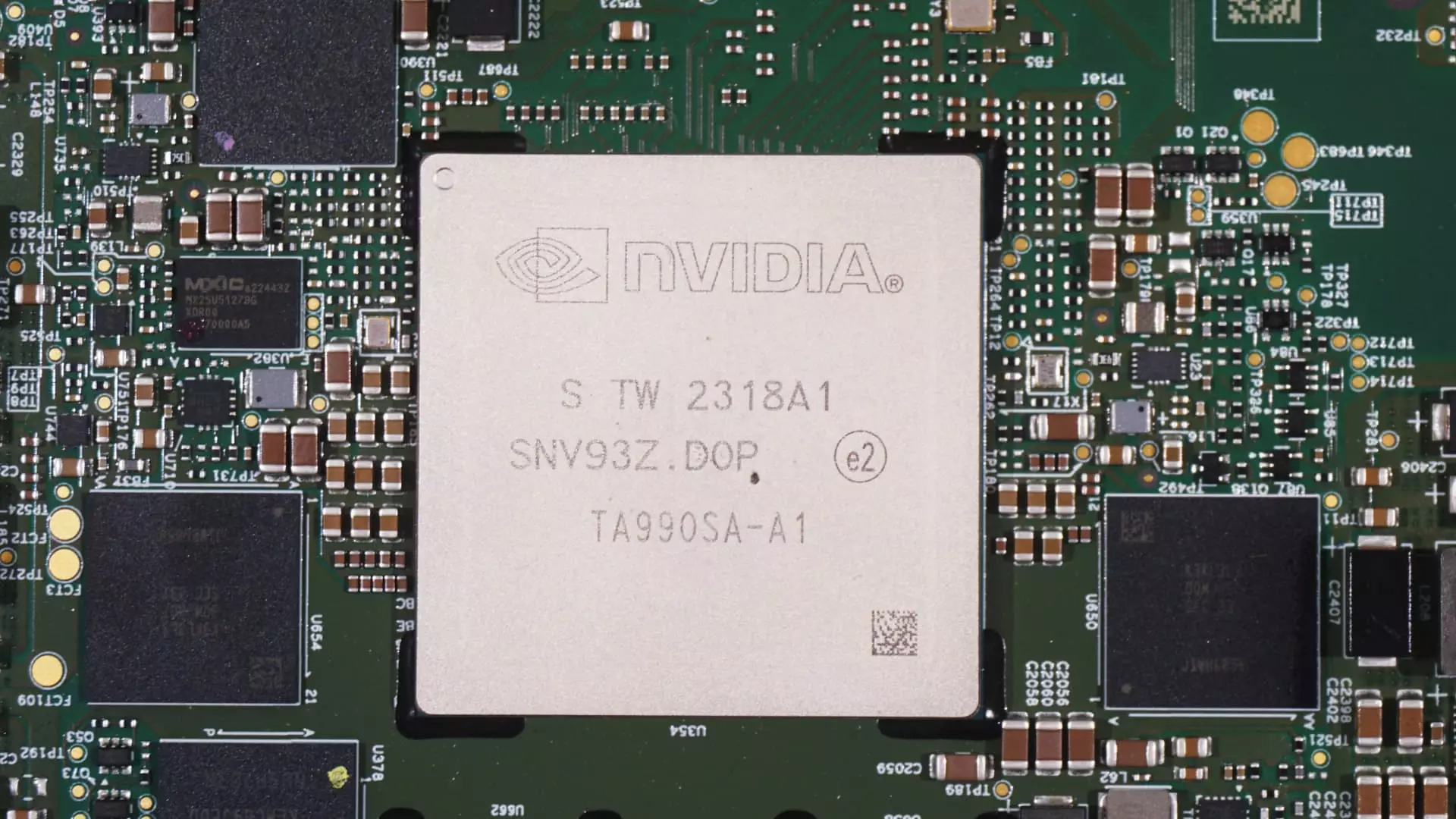

The Chipmakers as Market Barometers

Among the more surprising figures of the week were the chipmakers Broadcom and Nvidia, showcasing exceptional resilience amidst the turmoil. As stocks that were once battered last week suddenly surged, their trajectory after a retreat invites analysis. Such sharp recoveries illustrate an inherent market characteristic: historically bruised sectors often rebound when sentiment shifts in an uplifting direction.

It’s worth noting how these chipmakers rebounded in conjunction with positive news. Broadcom’s $10 billion stock buyback program and Nvidia’s ability to avoid strict tariff implications highlight an important intersection of corporate maneuvering and market psychology. Does this signify a newfound strength in these companies, or is it merely a temporary reprieve? The ongoing tug-of-war between perception and reality has real potential to either bolster or undermine investor confidence.

Economic Indicators and Market Sentiment

As investors look towards upcoming earnings reports and economic indicators, the landscape remains fraught with caution. The forthcoming data from the Bureau of Labor Statistics and the Census Bureau holds the potential to either fan the flames of optimism or douse them with cold water. With consumer spending being a critical linchpin for economic health, any sign of weakening demand could sway investor confidence significantly.

Moreover, how market participants interpret these indicators will shape sentiments in myriad ways. We remain tethered to an economy that exists within a broader global tapestry, and while analytical frameworks may offer nudges in strategic thinking, these indicators amplify the risk-reward dynamic that defines modern trading. In this intricate dance, stakeholders must come to terms with personal biases and external pressures alike.

As Wall Street grapples with an unpredictable landscape, one fundamental truth remains: certainty is dead, but opportunity endures in newfound resilience amidst chaos.

Leave a Reply