Each year, the Berkshire Hathaway annual meeting becomes a microcosm of modern American values, reflecting the intersections of wealth, community, and social responsibility. This year’s meeting surpassed expectations, not merely as a financial event but as a monumental philanthropic occasion, raising over $1.3 million to support the Stephen Center, a local charity dedicated to aiding the homeless and providing addiction recovery programs. Unlike the usual shareholder gathering focused solely on stock prices and markets, this event emphasized the profound and often overlooked impact that successful individuals can have on their communities.

With the enigmatic figure of Warren Buffett at the helm—often dubbed the “Oracle of Omaha”—the atmosphere was electrified by a mix of excitement, nostalgia, and genuine altruism. Attendees were not there simply to rub shoulders with an investment legend; they were drawn by the opportunity to contribute meaningfully to the lives of others, demonstrating how philanthropic endeavors should be integral to modern capitalism.

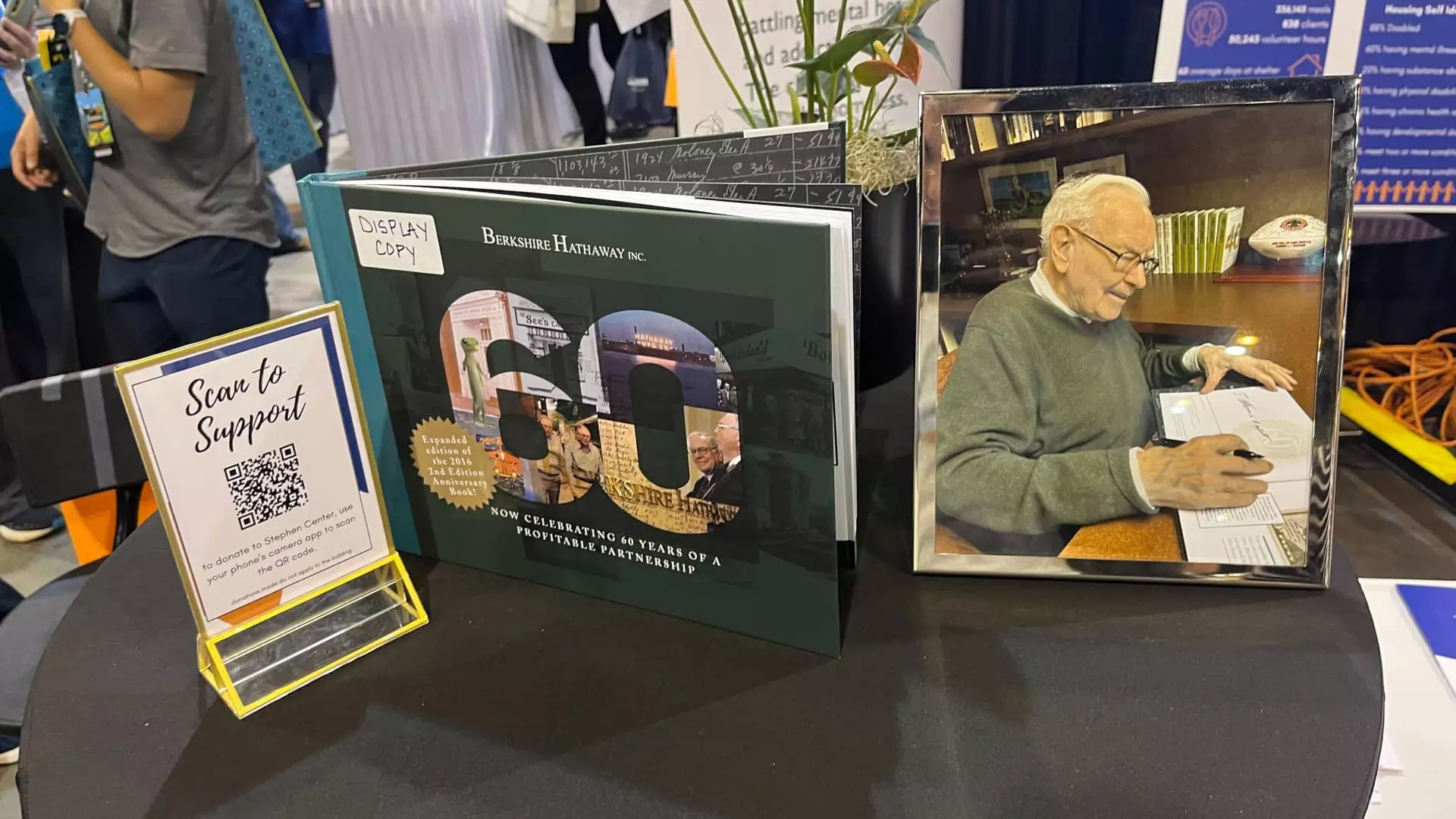

Auction Fever: The Allure of Signed Memorabilia

The auction frenzy culminated in a bidding war for exclusive signed copies of “60 Years of Berkshire Hathaway,” pushing the limits of what shareholders are willing to pay for a piece of history. Here, one can’t help but view the intersection of personal passion and social responsibility. Matthew Rodriguez, a 43-year-old real estate professional from Omaha, made headlines with his $50,000 bid, but what was more striking was his sentiment of wanting to own a piece of Buffett’s legacy while simultaneously supporting a charitable cause.

This phenomenon speaks volumes about how our priorities can shift. In a world often dominated by ego and competition, Rodriguez’s mindset—valuing a signed book for its potential to help others—highlights a critical evolving attitude toward wealth. The auction brought in not just cash, but a robust spirit of community engagement, with various donors—even those who couldn’t attend—reaching out to the Stephen Center to contribute.

Buffett’s Legacy: A Call to Action

Buffett’s longstanding leveraging of his wealth to benefit society stands as a powerful reminder of the responsibility that accompanies financial success. During this year’s meeting, he announced not only his retirement plans but also his commitment to matching auction proceeds, further motivating shareholders to dig deep. This sort of leadership encapsulates the essence of altruism in a capitalist framework, questioning the typical perception of wealth accumulation solely for personal gain.

The fundraiser was not just about the money; it was about instilling a sense of community stewardship among shareholders. In a context where many wealthier individuals detach themselves from societal responsibilities, Buffett’s actions serve as a model that advocates integrative philanthropy. By aligning financial success with impactful charitable contributions, he not only cultivated a culture of giving but challenged stakeholders to engage actively in community upliftment.

Real Stories Behind the Numbers

The stories emerging from the event add another layer of significance. Take Jay Ji, an investment manager whose personal history of hardship resonated in his winning bid of around $20,150. His experience fuels a determination to alter the fate of families in similar situations, highlighting a rediscovery of empathy and social accountability in the world of finance.

These narratives reaffirm the notion that true success is not measured solely in profit margins but in the lives impacted through acts of kindness and generosity. What’s noteworthy is how these individual stories contribute to a larger narrative of socio-economic responsibility, effectively utilizing personal gains to mitigate collective woes.

Building a Better Future: Sustaining the Momentum

Moving beyond just monetary contributions, one of the fundamental takeaways from this year’s Berkshire meeting is the long-term influence such generosity and community involvement can exert. As the data indicates an alarming rise in homelessness—particularly among families and vulnerable populations—the funds raised will directly contribute to essential renovations and the development of new facilities to better serve those in need.

Furthermore, the attention that Buffett’s initiatives bring to local organizations can have a ripple effect, inspiring others in the financial sector to explore similar philanthropic avenues. Philanthropy should not be an afterthought but a core pillar of any financial venture. By embodying this philosophy, Buffett encourages a new norm among upcoming generations of investors, steering them towards a more holistic approach to capital and community engagement.

In the broader context of his $99 billion fortune, Buffett’s lifetime commitment to charity sends a resounding message: we have a shared duty to uplift others, drawing the blueprint for a modern, compassionate economy that values life equally as it does profit.

Leave a Reply