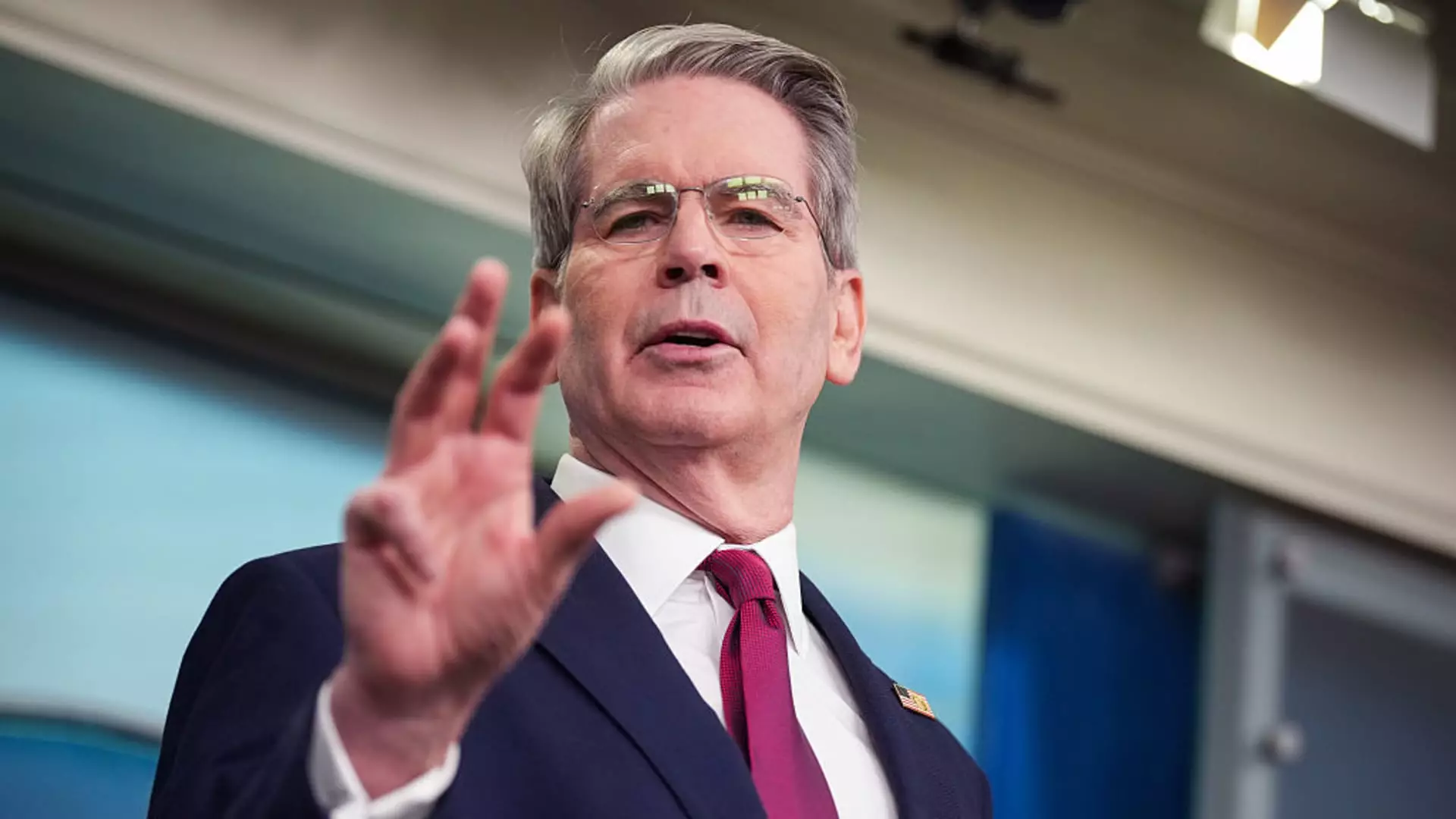

In a world where uncertainty prevails, the recent commentary from Treasury Secretary Scott Bessent reveals a peculiar resilience among individual investors. He highlights that, despite a churning stock market enflamed by President Trump’s aggressive tariff policies, everyday Americans remain steadfast. This steady hold on investments speaks volumes about not just their confidence in the president but also a broader shift in the psychology of retail investors compared to their institutional counterparts. While hedge funds scramble and panic, small investors seem to possess a fortitude rooted in faith and perhaps a touch of naivety.

The Contradictions of Trust

It’s somewhat ironic that while 97% of individual investors have chosen inaction, the market itself tells a different story. The S&P 500 has faced severe turbulence, momentarily plunging into a bear market, and raising serious questions about the sustainability of economic policies. True, Trump’s tariffs aim to fortify American interests, but their immediate effects—rising consumer prices and potential shortages—could quickly crumble any notion of protectionism. Can long-term trust override the clear signs of an ailing economy? Bessent’s assertion seems to romanticize a situation that is fraught with contradictions, where blind faith might soon give way to harsh realities.

The Shift in Investor Landscape

Retail investors buying into bearish markets is not a new phenomenon, yet this mass buy-in represents a departure from traditional behavioral finance paradigms. Typically, institutional investors, armed with extensive resources and data, dictate market movements. However, recent patterns indicate a dramatic shift. Hedge funds were quick to pile on short positions, echoing institutional fear that the tariffs would impose deeper economic woes. In contrast, individuals—perhaps emboldened by a combination of amateur-day trading platforms and a genuine belief in American resilience—entered the fray, sniping up undervalued stocks. This pivot suggests a disruption of old norms; individual investors could very well be redefining who holds sway in today’s markets.

The Looming Recession

Meanwhile, economic forecasters like Torsten Slok cautiously predict an imminent recession, citing trade-related shortages as a potential tipping point. Their concerns are not unfounded; as consumers brace for the fallout of tariff-induced inflation, retail investors may soon find themselves at odds with their optimistic outlook. There’s a delicate line between holding tight and being utterly oblivious to the storm brewing on the horizon. The dissonance becomes even more pronounced when heavyweights like Ken Griffin warn that Trump’s trade wars are tarnishing not just the U.S. brand but also the global perception of American financial stability.

In this financial tug-of-war, can retail investors remain resolute in their beliefs as the tide of economic downturn rolls in? It’s a captivating drama, underscored by the uncomfortable reality that emotional investing often leads to perilous consequences, particularly for those who are less acquainted with market intricacies. Perhaps in the face of chaos, a reflective analysis on the nature of trust becomes not only prudent but necessary for navigating this brave new investing landscape. Is the future of investing, driven by faith rather than rationality, a model to emulate—or a path to reckoning?

Leave a Reply