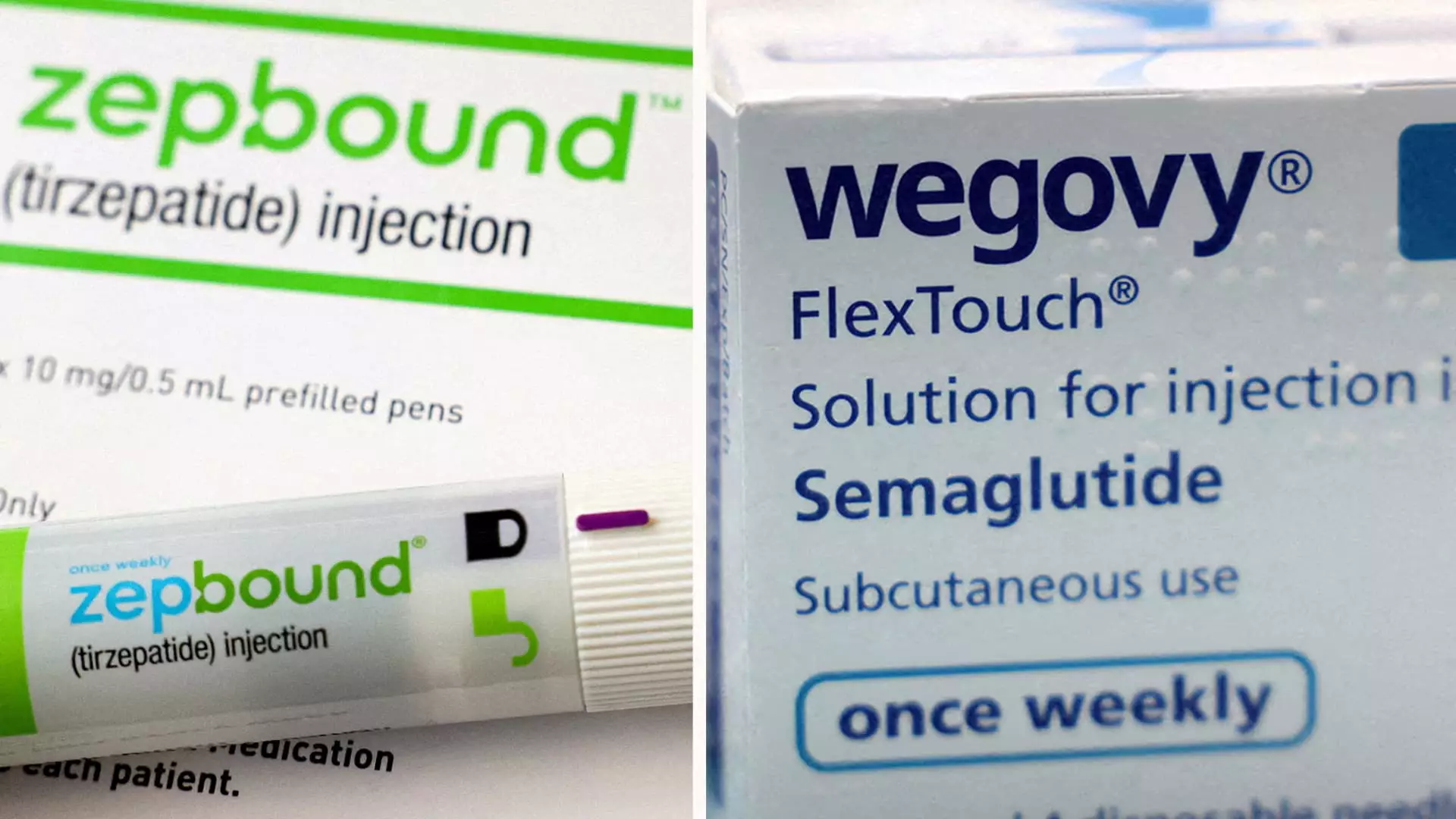

In a significant turn of events in the realm of obesity treatment, Eli Lilly recently announced that its new weight loss medication, Zepbound, has demonstrated superior results compared to Novo Nordisk’s long-standing contender, Wegovy. This revelation comes from the first head-to-head clinical trial involving these two injectable drugs specifically designed to assist those struggling with obesity or overweight conditions. The trial showcased that Zepbound participants experienced an impressive average weight loss of 20.2% over 72 weeks, equating to approximately 50 pounds. In contrast, Wegovy users reported a more modest average weight reduction of 13.7%, or about 33 pounds, during the same timeframe.

The details of this phase three trial reveal that Zepbound’s efficacy surpasses Wegovy’s, highlighting a substantial 47% increase in relative weight loss. Additionally, more than 31% of participants on Zepbound succeeded in shedding at least a quarter of their body weight, compared to roughly 16% of those treated with Wegovy. This stark contrast not only shines a light on Zepbound’s potential but also raises critical questions regarding the effectiveness of current weight loss treatments on the market.

Separate studies further back the claim of Zepbound’s superiority. Late-stage trials indicated that patients could expect to lose over 22% of their weight on average with Zepbound, while Wegovy reportedly resulted in a 15% weight reduction over a similar period. However, the latest trial stands out due to its rigorous methodology, involving random assignments of 751 patients receiving either drug at maximum doses. The trial specifically monitored patients who were obese or overweight while also dealing with one weight-related medical condition, excluding diabetes.

The implications of these findings are significant for both healthcare providers and patients. As noted by Dr. Leonard Glass of Eli Lilly, the study is instrumental in shaping informed decisions regarding obesity treatment options. Given the escalating interest in medications for weight loss, robust evidence is essential for healthcare professionals faced with recommending treatments amidst a constantly evolving pharmaceutical landscape.

As Eli Lilly prepares to publish these findings in a peer-reviewed journal and present them at an upcoming medical conference, the pressure mounts to solidify Zepbound’s position in the marketplace. Notably, both Zepbound and Wegovy share similar side effects, predominantly gastrointestinal, which tend to be mild to moderate in severity. This aspect is crucial for patients to consider as they weigh the benefits and risks associated with each medication.

The market for obesity treatments is rapidly expanding, with some analysts estimating its future worth to reach $150 billion annually by the early 2030s. Despite Wegovy being introduced two years prior to Zepbound, expectations are high for Zepbound to emerge as a leader in sales shortly after its release, which earned FDA approval in late 2023. Forecasts from GlobalData suggest that Zepbound could generate an astounding $27.2 billion in annual sales by 2030, dwarfing Wegovy’s anticipated $18.7 billion revenue during the same period.

However, the surge in demand for both drugs, along with their diabetes counterparts, has strained supply chains, compelling Eli Lilly and Novo Nordisk to invest billions to expand their production capabilities. As a response to these pressures, the FDA recently classified all doses of these treatments as “available,” alleviating some shortages, but challenges persist. Patients often encounter barriers to accessing these drugs, frequently due to inconsistent insurance coverage for weight loss medications in the United States.

An important aspect to consider is the differing mechanisms of action between Zepbound and Wegovy. Zepbound operates by regulating appetite and blood sugar through the activation of two gut hormones, GIP and GLP-1. In contrast, Wegovy primarily targets GLP-1, without engaging GIP. Thus, researchers speculate that Zepbound may provide an enhanced mechanism for managing sugar and fat breakdown in the body, potentially leading to more significant weight loss outcomes.

As the investigations continue into Zepbound’s potential as a premier weight loss solution, the comparative results with Wegovy spotlight a transformative opportunity within the obesity treatment landscape. For patients desperately seeking effective therapies, this clinical trial could signify a turning point, positioning Zepbound as a beacon of hope in the ongoing battle against obesity.

Leave a Reply