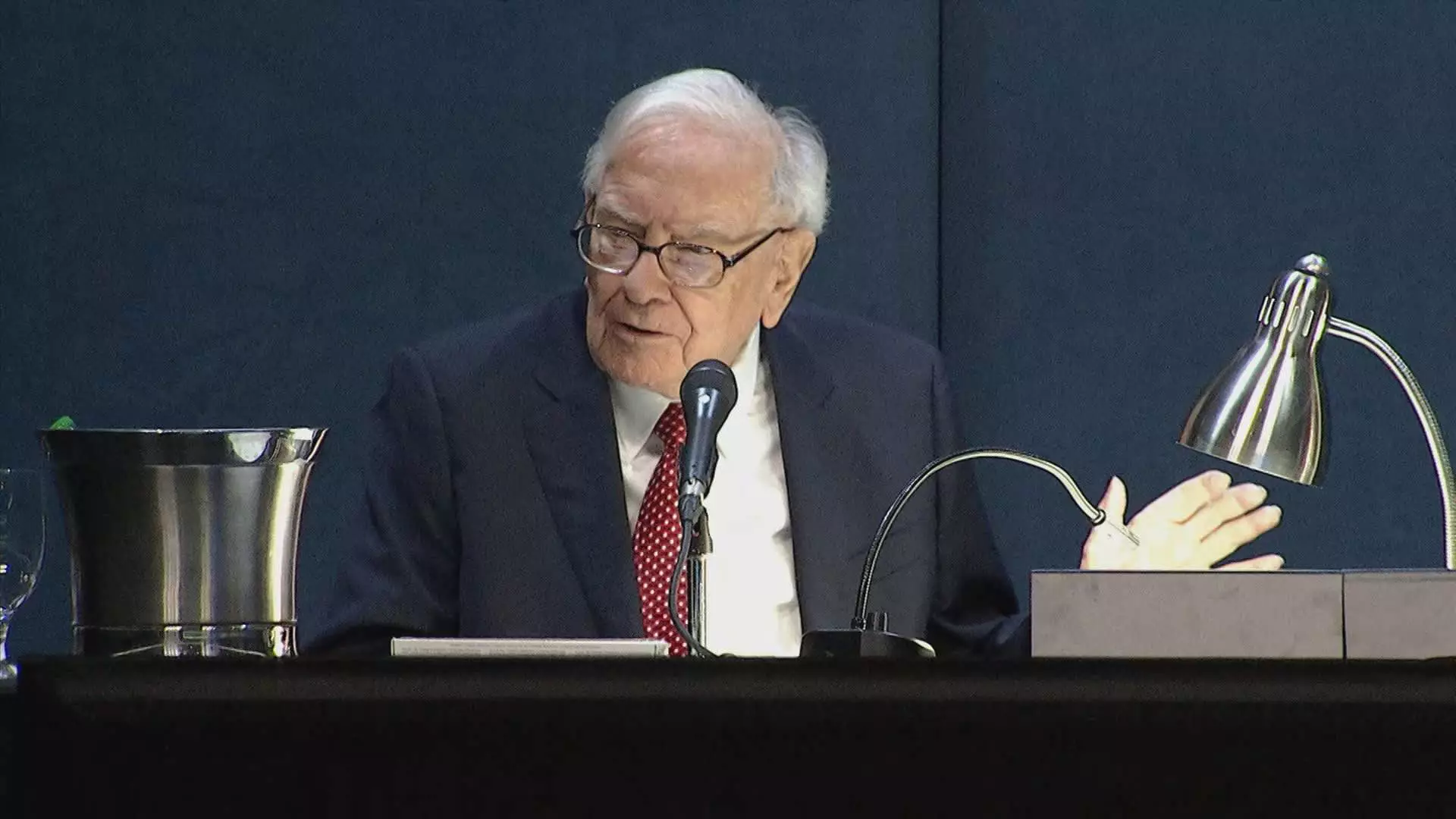

Warren Buffett’s equity holdings have always been a topic of great interest among investors and analysts alike. Recently, a regulatory filing disclosed that Buffett now owns the exact same number of shares in Apple and Coca-Cola – a staggering 400 million shares in each company. This revelation has sparked a debate among followers of the legendary investor, raising questions about whether this symmetry is a mere coincidence or a calculated master plan.

Buffett’s long-standing relationship with Coca-Cola dates back to 1988 when he first purchased 14,172,500 shares of the company. Over the years, he steadily increased his stake in Coca-Cola to reach 100 million shares by 1994. What is particularly interesting is that Buffett has maintained this round-number share count for over three decades, demonstrating his unwavering commitment to the iconic soft drink brand. Through stock splits in 2006 and 2012, Berkshire’s Coca-Cola holding eventually reached 400 million shares, mirroring his Apple investment.

Despite being known for his value investing principles, Buffett’s foray into tech giant Apple has raised eyebrows in the investment community. Rather than viewing Apple purely as a technology stock, Buffett has likened it to a consumer products company similar to Coca-Cola. He has emphasized the appeal of Apple’s loyal customer base, comparing its importance to Berkshire Hathaway’s core businesses. While Berkshire significantly reduced its Apple stake in the second quarter, many believe this decision was driven by portfolio management considerations rather than a negative outlook on the company’s future prospects.

The equal 400 million share count in both Apple and Coca-Cola holdings has led to speculation about Buffett’s intentions regarding his investments. Some suggest that Buffett’s affinity for round numbers may indicate that he does not plan to further reduce his Apple position. By settling at this particular share count, Apple seems to have attained a status similar to Coca-Cola as one of Buffett’s “permanent” holdings. However, others argue that this alignment could simply be a pure coincidence, as Buffett himself has hinted that his investment decisions are not driven by such factors.

Warren Buffett’s distinctive approach to investing has long been a source of fascination for market observers. His ability to see the long-term potential in companies like Coca-Cola and Apple, despite their contrasting industries, underscores his adaptability and foresight as an investor. While the symmetry in his share holdings may spark curiosity and speculation, ultimately, it is Buffett’s steadfast belief in the intrinsic value of these companies that guides his investment decisions. As he famously stated at Berkshire’s annual meeting, his holding period for both Coca-Cola and Apple is infinite, highlighting his enduring commitment to these iconic brands.

Leave a Reply