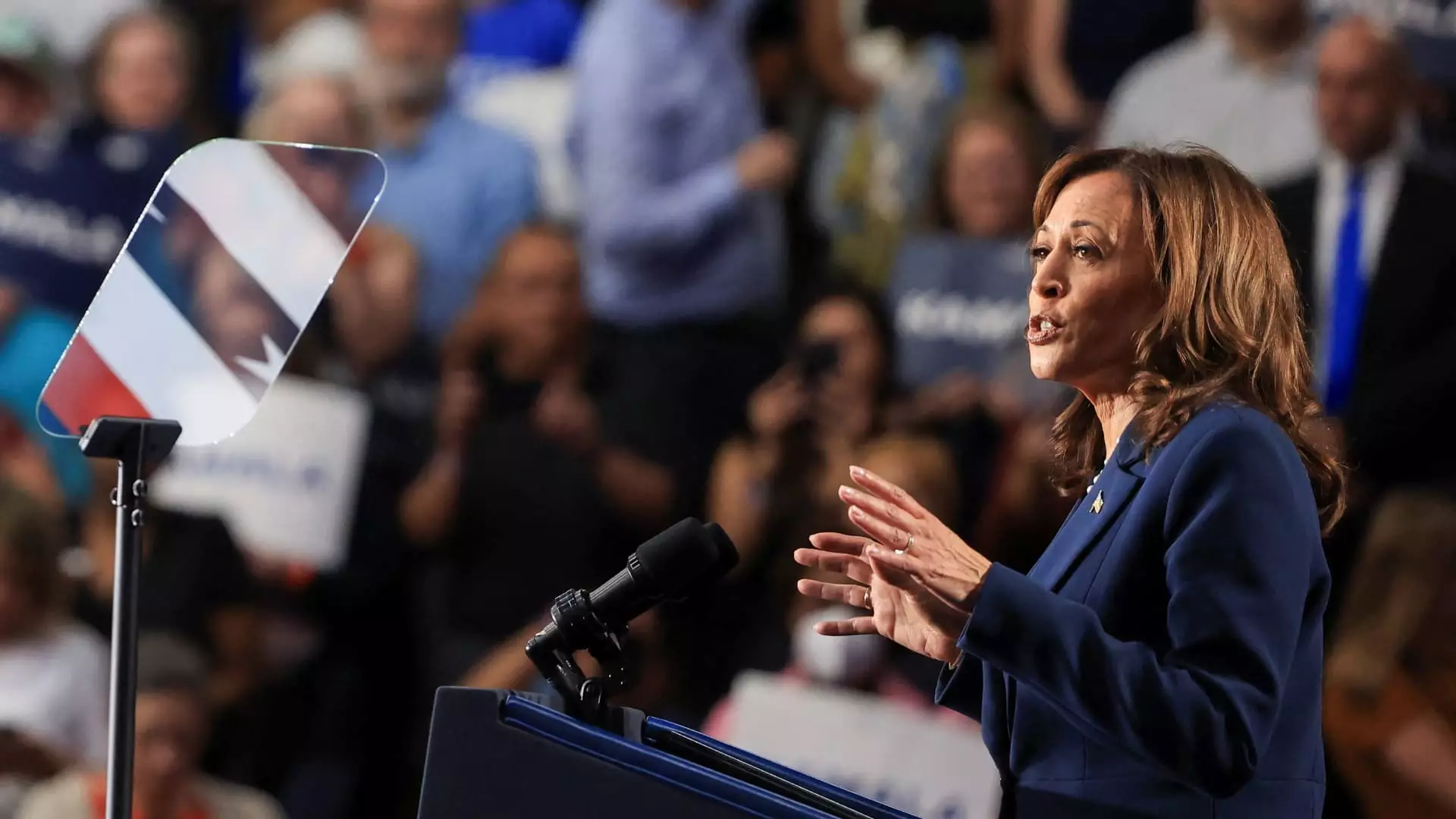

The emphasis on strengthening the middle class has emerged as a pivotal focus of Vice President Kamala Harris’s campaign as she positions herself as a frontrunner to succeed President Joe Biden for the Democratic nomination. Speaking at a political event in West Allis, Wisconsin, she proclaimed, “Building up the middle class will be a defining goal of my presidency.” This statement underscores a broader strategy of addressing the wealth gap, which has increasingly become a concern among American families struggling to keep up with rising living costs.

Harris’s assertion that the strength of the middle class is synonymous with the strength of America echoes sentiments she has communicated throughout her political career. The recognition of the middle class as the backbone of the economy prompts a reevaluation of policies that favor this demographic. In her earlier tenure as a senator, Harris introduced the LIFT (Livable Incomes for Families Today) Act, which proposed an annual tax credit aimed at alleviating financial burdens on lower- and middle-income workers. This initiative is positioned as a necessary relief in an era of increasing financial strain, particularly regarding housing costs that disproportionately affect renters.

Francesco D’Acunto, a finance professor at Georgetown University, argues that the LIFT Act could offer stronger financial relief for renters than recent proposals from President Biden, which include a 5% cap on rent increases for larger property owners. While such a cap sounds promising, critics like economist Karl Widerquist have raised concerns about its potential unintended consequences. For instance, landlords may choose to remove units from the rental market to evade caps, exacerbating the scarcity of affordable housing.

The discourse around rent caps versus direct tax credits reflects a broader debate on the most effective ways to support those in need. Unlike Biden’s rent cap proposal, the LIFT Act does not introduce market distortions; instead, it offers straightforward financial assistance designed to offset rising rents. D’Acunto emphasizes that such tax credits would provide more direct support to renters by addressing their immediate concerns about affordability without creating dependence on policy that may falter in implementation.

As the economic landscape continues to shift with advancements in technology—particularly artificial intelligence—the apprehension regarding job security amongst workers grows. As automation threatens various job sectors, experts like Laura Veldkamp highlight the necessity of social safety measures. The proposed LIFT Act serves as a response to these uncertainties by ensuring that vulnerable workers receive reliable support to navigate an evolving job market.

While the intent behind the LIFT Act is commendable, its practicality hinges on securing adequate funding. Historical data from the Tax Policy Center indicates that financing such expansive tax relief could present significant hurdles. Harris’s previous strategy of repealing outdated tax cuts for higher earners attempts to offset costs, yet current economic realities, including an escalating federal budget deficit, complicate this endeavor.

Additionally, the political landscape has shifted since Harris first introduced the LIFT Act. Legislative priorities have evolved, with the child tax credit expansion taking center stage during the pandemic. The American Rescue Plan notably raised this credit as a pivotal tool for combating child poverty, highlighting a desperate need for immediate assistance to families. In 2021, this expansion was responsible for bringing child poverty down to a historic low of 5.2%, a remarkable achievement that underscores the efficacy of targeted tax relief.

As Harris contemplates her next steps, the choice between advocating for the LIFT Act or focusing on the child tax credit poses a challenging dilemma. Each approach carries distinct implications for supporting the middle class and addressing income inequality. The LIFT Act directly targets working-class individuals, thereby broadening the economic safety net. Conversely, the child tax credit expansion has already demonstrated its capacity to make a tangible impact on poverty rates.

Amidst ongoing economic uncertainty, Harris’s future policies will need to reflect not just an understanding of the diverse challenges facing American families but also a commitment to pragmatic solutions that resonate with voters. As these discussions unfold, it is critical for policymakers to remain attuned to the evolving needs of constituents and craft comprehensive strategies that bridge the wealth gap while fortifying the middle class. The necessity for coherent and forward-thinking economic policy is not merely an advantageous proposal but an urgent priority for the nation’s well-being.

Leave a Reply