With the upcoming election, voters are anxious to understand the personal finance policies of the presidential candidates, Vice President Kamala Harris and former President Donald Trump. There is a clear divide in their approaches to economic issues, and this article aims to dissect and analyze their stances on key financial matters.

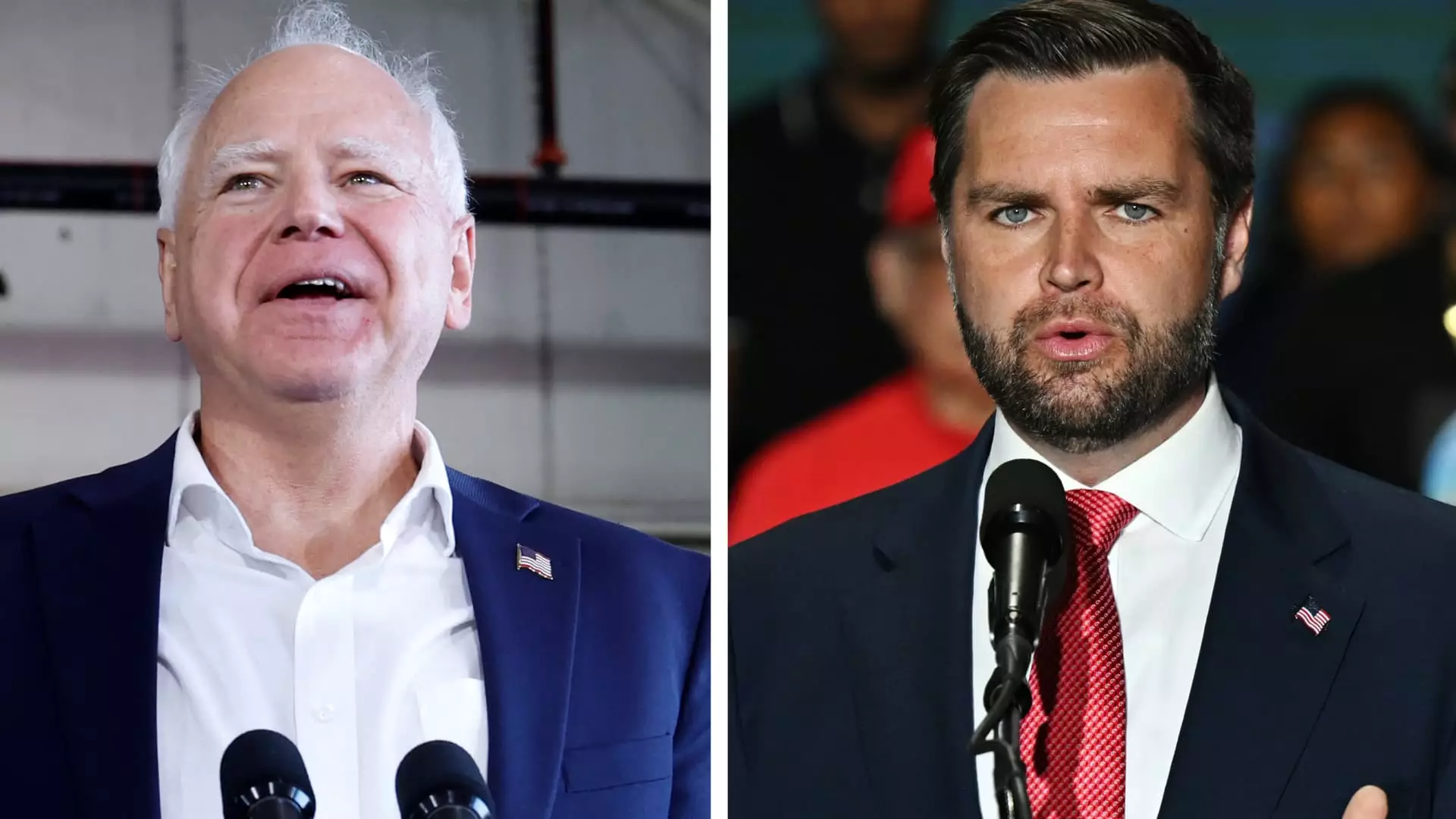

Both Kamala Harris and Donald Trump’s running mates, Tim Walz and JD Vance, have addressed the issue of affordable housing. Walz signed housing legislation in 2023, including significant financial allocations for down payment assistance and housing infrastructure. On the other hand, Vance has highlighted affordable housing in his campaign, emphasizing the importance of tackling poverty by addressing this critical issue. It’s clear that both candidates understand the significance of affordable housing, but their approaches may differ in execution.

The child tax credit is a vital financial support system for American families, and the candidates have differing views on its expansion. Minnesota recently enacted a refundable state-level child tax credit, which Walz described as a “signature accomplishment.” However, the federal child tax credit expansion faces challenges amidst a divided Congress and budget deficit concerns. Vance has voiced support for the child tax credit but has been critical of forgiving student debt, framing it as a benefit to the wealthy and corrupt university administrators. It’s evident that the candidates have contrasting views on financial support systems for families and individuals.

Student Loan Forgiveness

The issue of student loan forgiveness is another critical financial topic that Harris, Walz, and Vance have addressed. Vance has been vocal against forgiving student debt, claiming it primarily benefits the rich and well-educated. However, he has shown support for specific cases, such as parents with permanently disabled children. On the other hand, Walz, with a background in education, has championed programs to alleviate student loan debt burdens, including a student loan forgiveness program for nurses and a free tuition initiative for low-income students. It’s evident that the candidates have differing views on addressing the growing student debt crisis in the country.

The personal finance policies of Kamala Harris, Tim Walz, and JD Vance showcase a stark contrast in approaches to critical financial issues such as affordable housing, child tax credit expansion, and student loan forgiveness. As voters evaluate these candidates based on their economic policies, it’s essential to consider the implications of their proposed solutions on middle-class Americans and the overall economy. The upcoming election will undoubtedly have significant ramifications on the financial well-being of U.S. citizens, making it crucial to carefully analyze and understand the candidates’ positions on key financial matters.

Leave a Reply