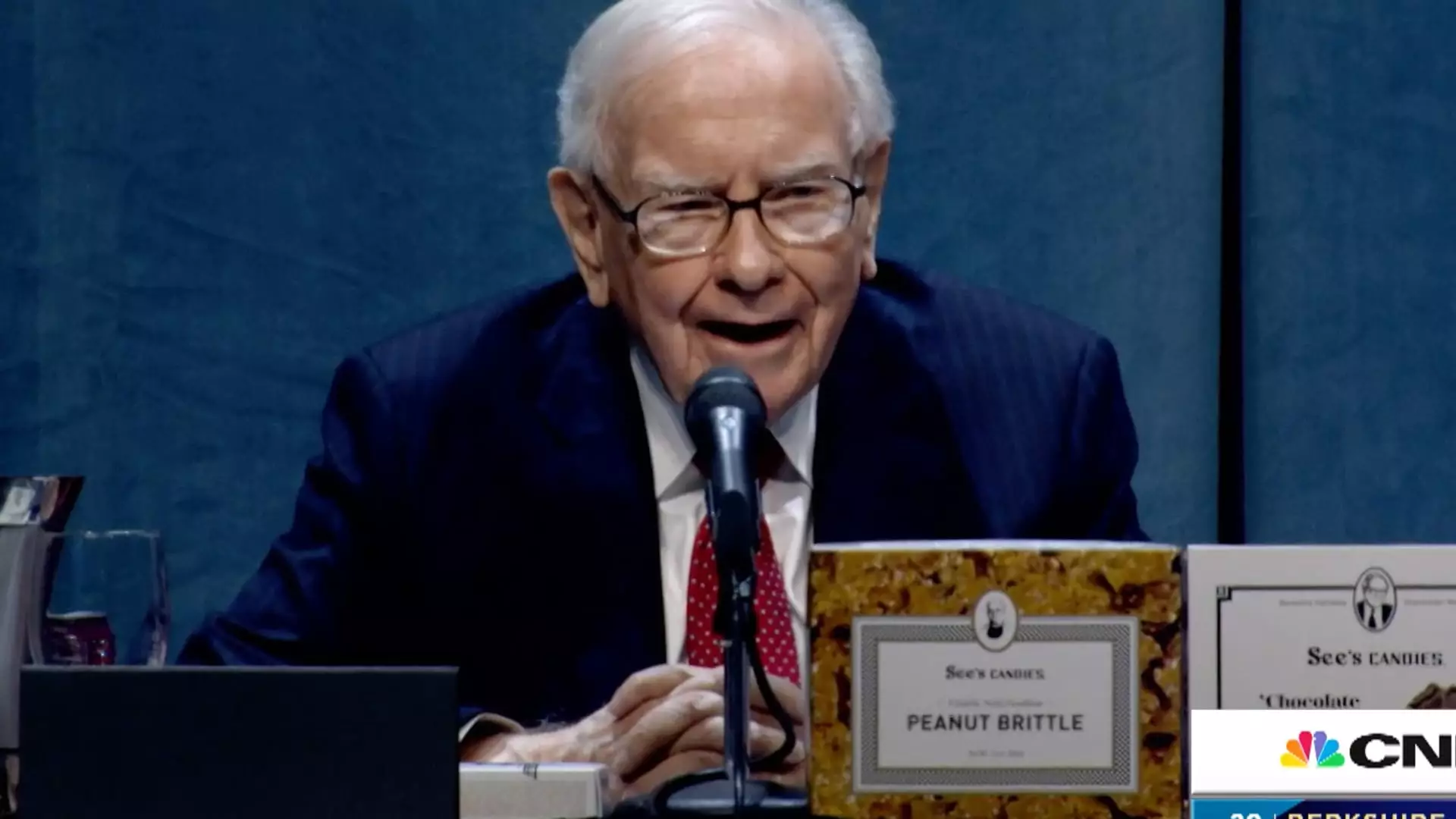

Warren Buffett, the renowned investor and chairman of Berkshire Hathaway, recently broke his silence regarding the economic implications of tariffs imposed by President Donald Trump. In a conversation with CBS News, Buffett illustrated the potential repercussions of such trade policies, emphasizing that certain economic strategies could induce inflation and adversely affect consumers. His remarks signify a significant concern: tariffs can be viewed as unconventional taxes that are ultimately borne by the public rather than absorbed uniformly by corporations.

Buffett’s analogy of tariffs as an “act of war” underscores the aggressive nature of such economic decisions, which can lead to heightened tensions and unpredictable consequences in global trade relations. By stating, “Over time, they are a tax on goods. I mean, the Tooth Fairy doesn’t pay ’em!” he encapsulates the paradox of tariffs—they may provide short-term governmental revenue but long-term burdens to consumers who face rising prices on imported goods.

Buffett’s Historical Context and Cautions

The remarks made by the 94-year-old billionaire resonate particularly as he draws from historical trends observed during previous trade disputes. While tariffs have been a recurring theme in economic policy, their effectiveness remains widely debated. Reflecting on experiences from the past, Buffett voiced his concerns, noting that aggressive tariff strategies could mirror the challenges faced in previous economic confrontations. Historical data suggests that trade conflicts generally result in adverse outcomes, including inflationary pressures that ultimately impact consumer purchasing power.

This recent commentary from Buffett is a deviation from his previous public discourse around trade conflicts, echoing his cautious stance from 2018 and 2019. In those discussions, he articulated the potential for adverse global repercussions stemming from such policies. His ability to remain vigilant and observe the evolving landscape showcases his prowess—not just in investment, but also in understanding economic fundamentals.

The Economic Landscape Ahead

Amidst his critical observations on tariffs and trade, Buffett remains reticent about offering predictions regarding the current state of the U.S. economy. In a reflective moment, Buffett confessed, “Well, I think that’s the most interesting subject in the world, but I won’t talk about it directly.” His non-committal responses suggest a deeper contemplative approach, possibly influenced by market instability, speculative risks, and the broader implications of unpredictable governmental policies.

In light of the present uncertainties, Buffett’s strategy of divesting stocks and accumulating cash may appear conservative. While some analysts interpret these actions as a bearish signal, others speculate that they are tactical moves intended to position Berkshire Hathaway for a future economic transition—perhaps to facilitate a seamless succession plan.

The S&P 500 has seen modest gains recently, with an increase of just 1% thus far in the year, indicative of a market grappling with volatility and economic trepidations. As the landscape continues to fluctuate, Buffett’s insights serve as an important reminder of the interconnectedness of trade policies and their far-reaching ripple effects on both consumers and investors alike.

Buffett’s take on tariffs reflects a seasoned understanding that resonates deeply in an economy marked by uncertainty. His perspective sheds light on the necessity of cautious and informed policy-making in trade, urging stakeholders to consider the broader implications of their fiscal decisions.

Leave a Reply