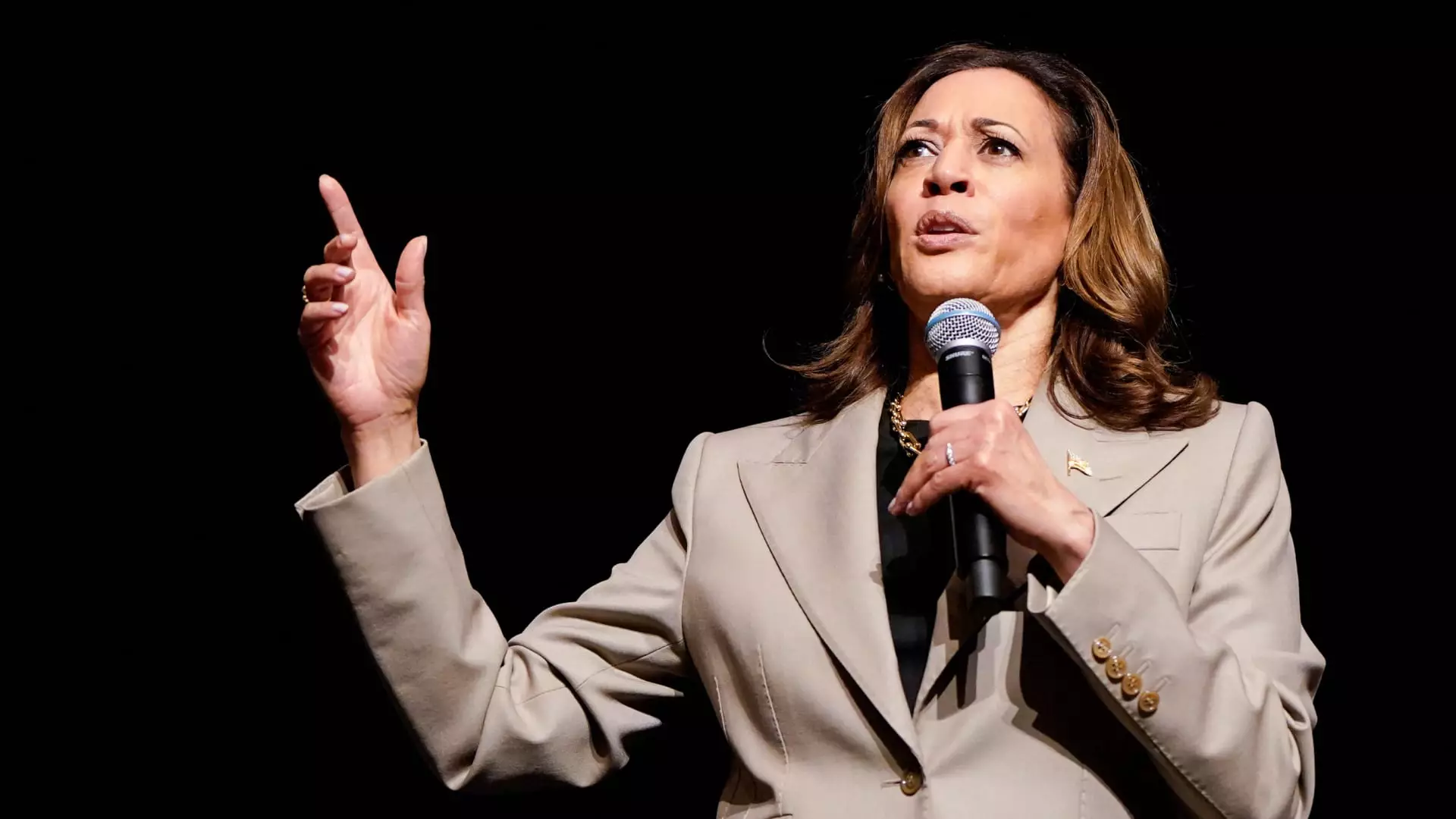

Vice President Kamala Harris recently announced an economic plan that includes an expanded child tax credit of up to $6,000 for families with newborn children. This proposal aims to build on the child tax credit enacted through the American Rescue Plan in 2021, which provided tax relief of up to $3,600 per child. Harris’ plan focuses on increasing support for middle- to lower-income families during the first year after a child is born.

Analysis of the Plan

While the intention behind Harris’ proposed tax break is to provide much-needed financial assistance to struggling families, there are several aspects of the plan that may raise concerns. For instance, the increased credit for newborns could be seen as a political move in response to similar proposals put forth by opposing parties, such as the $5,000 child tax credit suggested by Sen. JD Vance. This raises questions about the true motivation behind Harris’ plan and whether it is driven by genuine concern for families or political strategy.

Furthermore, the fact that Senate Republicans previously blocked an expanded child tax credit that had passed in the House with bipartisan support highlights the challenges in implementing such initiatives. Despite claims of bipartisan momentum behind expanding the child tax credit, the reality is that political gridlock often prevents meaningful progress on crucial economic issues.

Future Implications

Looking ahead, the fate of the child tax credit expansion will largely depend on which party controls the White House and Congress. The expiration of Trump’s 2017 tax cuts in 2025 poses a potential threat to the maximum child tax credit, as it is set to drop back to $1,000 without legislative action. This underscores the importance of ongoing discussions and negotiations to ensure continued support for struggling families.

Additionally, the significant costs associated with expanding the child tax credit raise economic concerns. Estimates suggest that increasing the credit to $3,000 or $3,600 could cost up to $1.1 trillion over a decade, while the proposed $6,000 credit for newborns could amount to $100 billion. In a time of growing federal budget deficits and competing priorities, lawmakers face tough decisions about where to allocate limited resources.

While Vice President Kamala Harris’ economic plan to expand the child tax credit shows a commitment to supporting families in need, there are valid criticisms and challenges that need to be addressed. The political nature of such proposals, the uncertainty surrounding bipartisan cooperation, and the financial implications of expanding the credit all point to the complexities of enacting meaningful economic policies. As discussions continue and decisions are made, it is crucial to prioritize the well-being of families and children while also considering the broader economic impact of these initiatives.

Leave a Reply