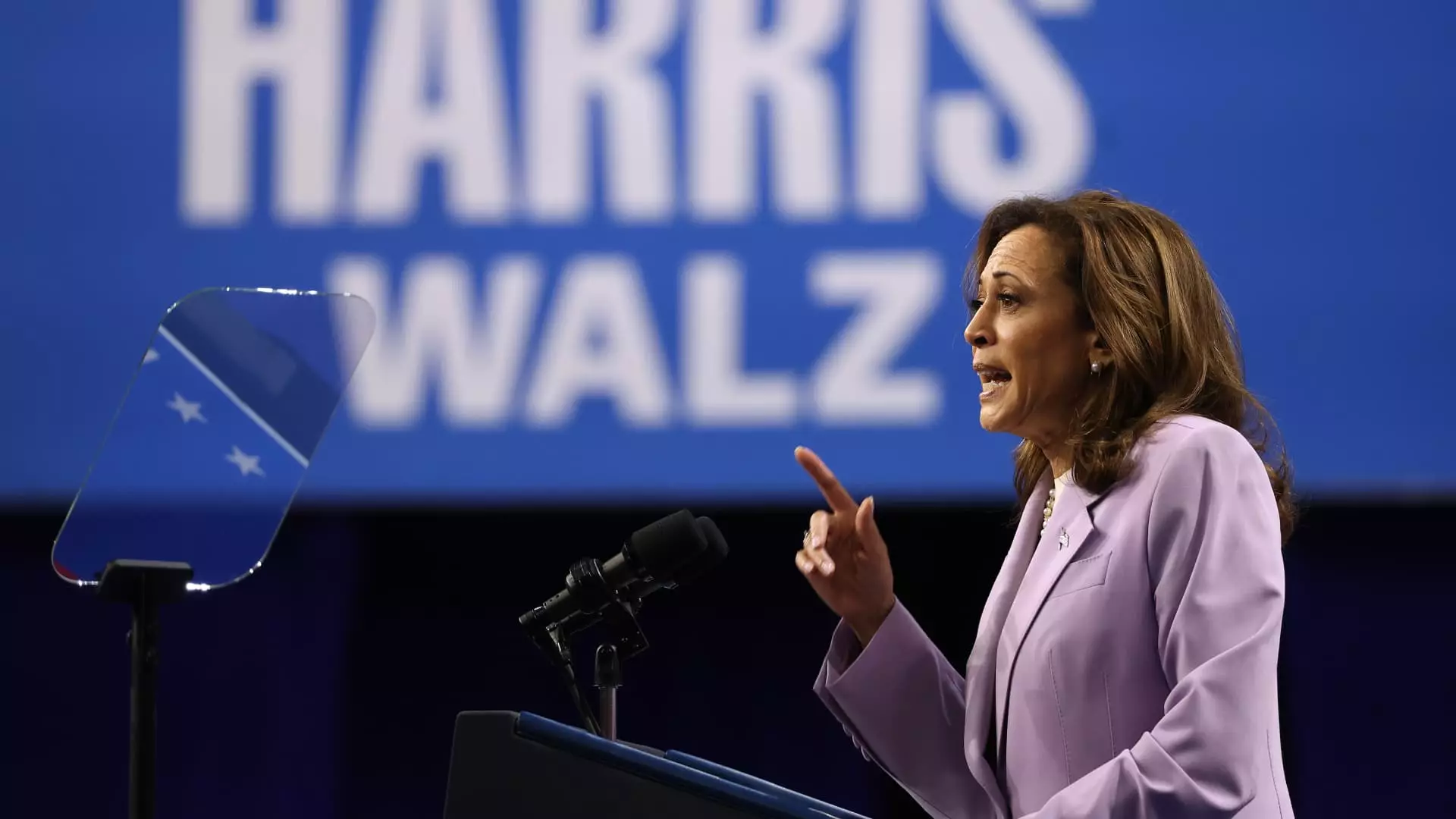

Affordable housing is a critical issue in the United States that has gained significant attention from policymakers. Vice President Kamala Harris recently unveiled her economic policy pitch, which included proposals to lower the costs of owning and renting a home in the U.S. However, the housing plans put forth by both Harris and former President Donald Trump face numerous challenges in gaining bipartisan support and feasibility.

Edward Pinto, a senior fellow at the American Enterprise Institute’s Housing Center, has expressed skepticism about Harris’ housing plan. He believes that it may be “worse than doing nothing,” highlighting the difficulty in passing supply-side proposals compared to demand-side efforts that make homebuying easier for consumers. This raises concerns about the effectiveness of Harris’ initiatives in addressing the affordability crisis in the housing market.

One of the key aspects of Harris’ housing plan is the focus on constructing 3 million new housing units, including starter homes for first-time buyers. However, there is a lack of clarity surrounding the definition of a “starter home.” James Tobin, CEO of the National Association of Home Builders, emphasized the challenges in defining a starter home due to varying costs in different markets.

Tobin pointed out that factors such as labor costs, land costs, borrowing costs for builders, and material costs make it difficult to keep building expenses low. This ambiguity in defining a starter home raises questions about the practicality and affordability of such housing units, particularly in high-cost markets like California.

Harris has proposed a $40 billion innovation fund aimed at empowering local governments to support local solutions for building housing. However, some experts are skeptical about the feasibility and effectiveness of this approach. Daryl Fairweather, chief economist at Redfin, expressed concerns about the federal government’s limited authority over local planning commissions and homeowners’ resistance to building more housing.

Additionally, Dennis Shea, executive director of the Bipartisan Policy Center’s J. Ronald Terwilliger Center for Housing Policy, raised doubts about the high price tag associated with the housing innovation fund. He questioned whether the market and Congress would be willing to bear such costs, indicating potential challenges in securing bipartisan support for Harris’ initiative.

Another key component of Harris’ housing plan is the provision of $25,000 down-payment assistance to first-time homebuyers who have paid rent on time for two years. While this proposal aims to support aspiring homeowners, there are concerns about its impact on housing demand and affordability. Senator Tim Scott, R-S.C., criticized the down-payment assistance for potentially driving up prices and increasing the risk of default among beneficiaries.

Harris also addressed the issue of predatory investing in rental housing by calling for the passage of the Stop Predatory Investing Act and the Preventing the Algorithmic Facilitation of Rental Housing Cartels Act. These legislative measures aim to curb speculative investment and market manipulation by large investors in the rental housing sector. However, the effectiveness of these proposals in addressing the root causes of housing affordability remains uncertain.

While Harris’ affordable housing initiatives present ambitious goals and innovative strategies, they face significant challenges in terms of feasibility, bipartisan support, and practical implementation. Addressing these hurdles will require a nuanced approach that considers a range of factors influencing housing affordability, including market dynamics, regulatory barriers, and stakeholder interests. Only through comprehensive and collaborative efforts can meaningful progress be made in addressing the complex challenges of affordable housing in the United States.

Leave a Reply