MongoDB’s shares skyrocketed by 16% in after-hours trading following the release of their fiscal second-quarter earnings report. The company exceeded expectations with adjusted earnings per share at 70 cents compared to the anticipated 49 cents. Additionally, revenue came in at $478.1 million, surpassing the projected $464.1 million.

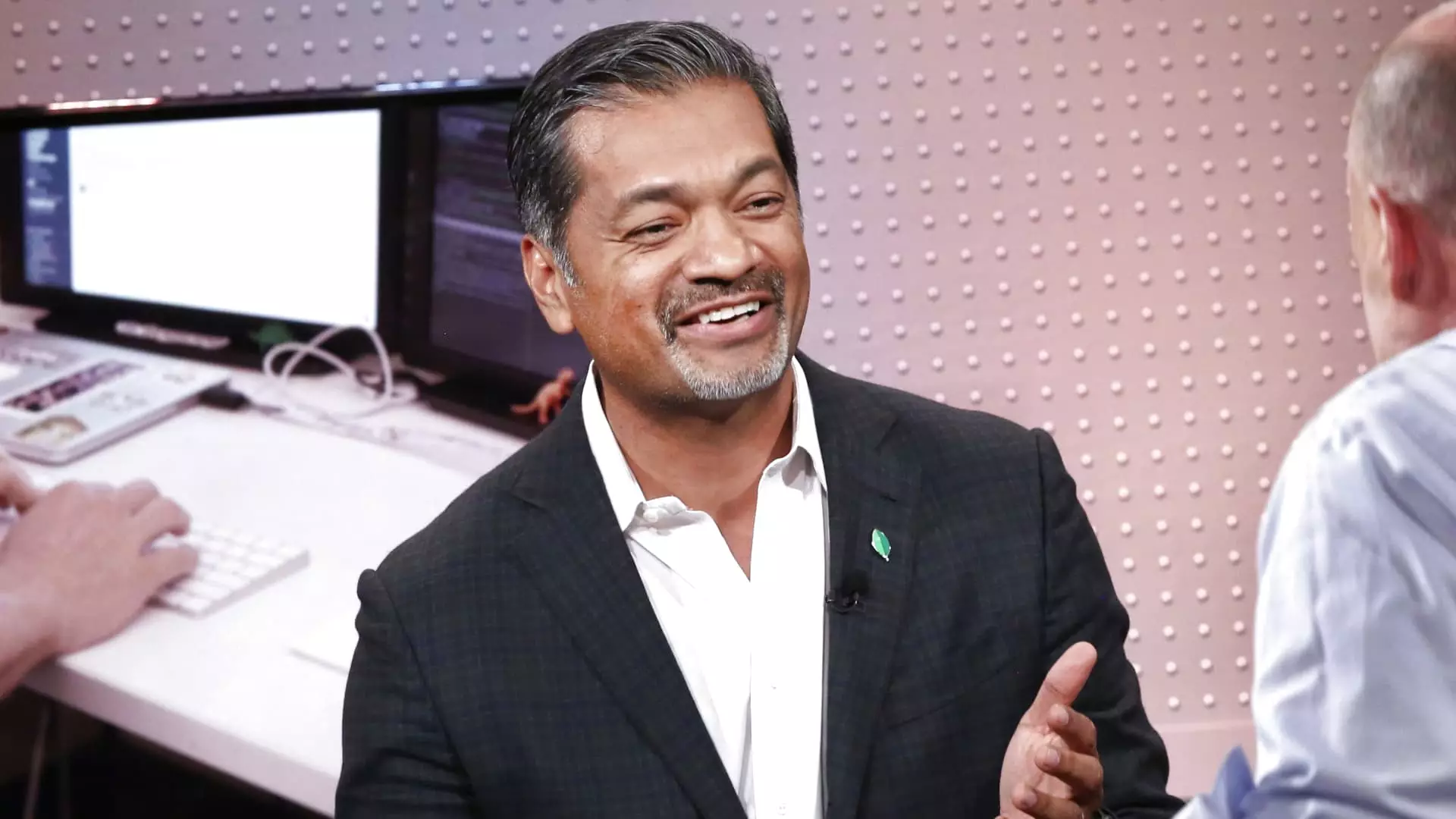

CEO Dev Ittycheria expressed confidence in MongoDB’s future prospects, stating that the company is well-positioned to assist customers in integrating generative AI into their operations and updating their outdated application portfolio. Despite challenges in the macroeconomic environment, MongoDB has continued to attract new business and expand its offerings.

In contrast to search software maker Elastic, which reported below-expected client commitments in the fiscal first quarter, MongoDB’s performance stood out. Ittycheria even mentioned assisting companies in transitioning from Elastic products during the earnings call, highlighting MongoDB’s competitive edge in the market.

For the fiscal third quarter, MongoDB anticipates adjusted earnings of 65 to 68 cents per share on revenue ranging from $493.0 million to $497.0 million. This guidance exceeded analysts’ expectations and illustrates the company’s optimistic outlook for the coming months. Furthermore, MongoDB revised its fiscal 2025 forecast upwards, now predicting adjusted earnings per share between $2.33 and $2.47 and revenue of $1.92 billion to $1.93 billion.

Despite the impressive earnings report and positive guidance, MongoDB shares have struggled in the market compared to the S&P 500 index. Excluding the after-hours surge, the stock was down nearly 40% year-to-date, while the broader market index showed a 17% gain over the same period. This discrepancy indicates potential market mispricing and the need for MongoDB to better communicate its value proposition to investors.

MongoDB’s recent financial performance showcases its resilience and growth potential in a competitive market landscape. By leveraging emerging technologies like AI and cloud database services, the company aims to drive innovation and meet the evolving needs of its customers. However, addressing market perceptions and enhancing investor confidence will be crucial for MongoDB to unlock its full growth potential in the future.

Leave a Reply