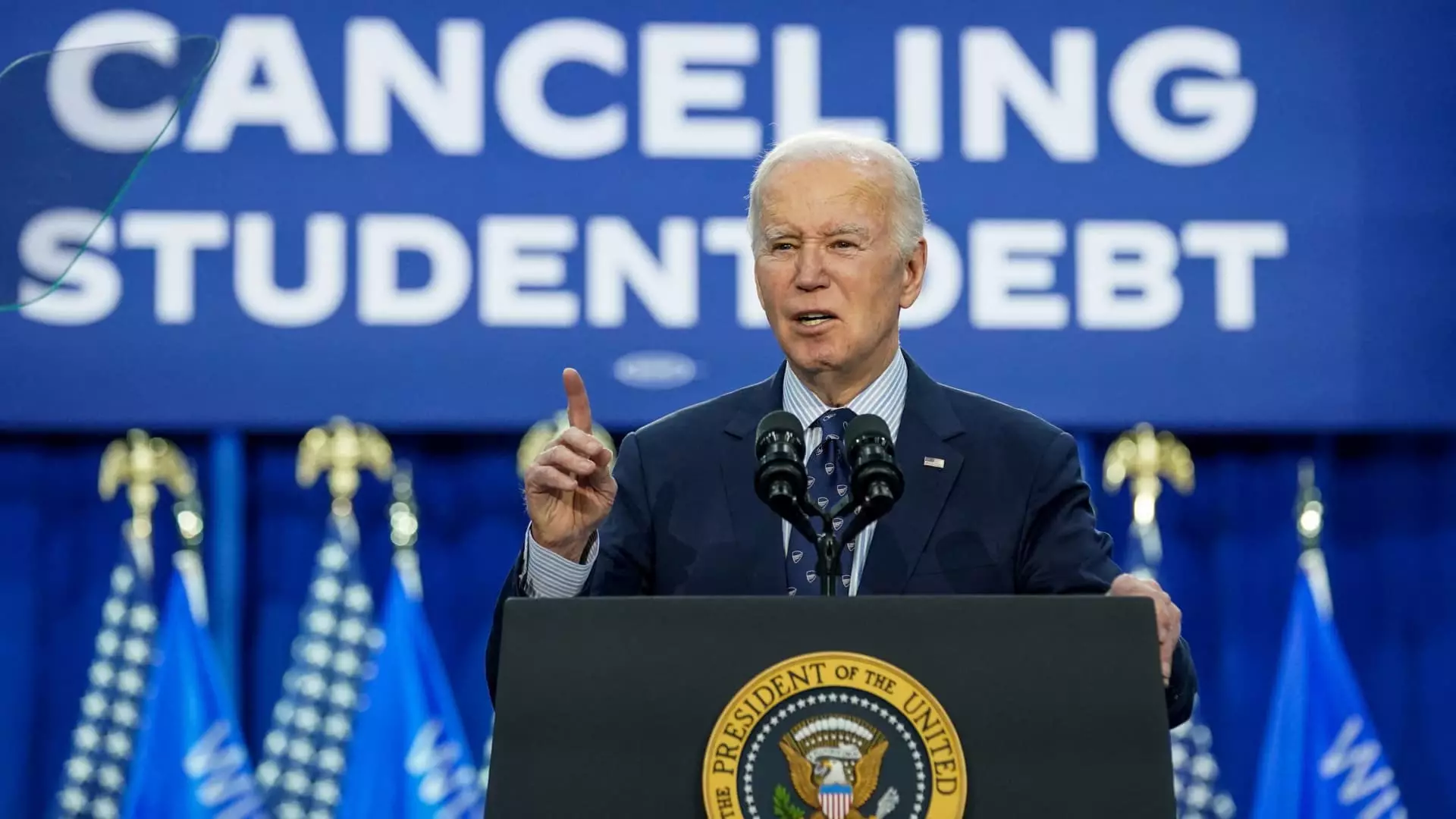

Recently, federal student loan borrowers received hopeful news about debt forgiveness from the Biden administration. However, before the U.S. Department of Education could move forward with its sweeping loan forgiveness plan, a challenge from Republican-led states has temporarily halted the relief. U.S. District Judge Randal Hall issued a temporary restraining order against President Joe Biden’s efforts to cancel student debt, responding to a lawsuit filed by seven Republican-led states. These states argued that the department was overstepping its authority, leading to the temporary block on the debt relief plan.

The Legal Battle

The states involved in the lawsuit against the debt cancellation effort include Alabama, Arkansas, Florida, Georgia, Missouri, North Dakota, and Ohio. They claimed that the Education Department’s plan was illegal, prompting the court to halt the implementation of the relief until further hearings in September. Legal experts suggest that it may take months for the courts to decide on the legality of the rule, leaving the fate of the loan forgiveness plan hanging in the balance.

After facing setbacks in previous attempts to cancel federal student debt, President Biden vowed to find alternative ways to provide relief to borrowers. Unlike his executive action in the past, the administration pursued a regulatory process this time to make the relief package less susceptible to legal challenges. While the final rule was not expected to be published until October, the lawsuit brought to light allegations that the Education Department had instructed loan servicers to erase loans earlier than scheduled. However, legal experts doubt the validity of these claims and believe that the administration will adhere to the regulatory process timeline.

The fate of the Biden administration’s wide-scale student loan forgiveness plan hangs in the balance as legal battles continue. Additionally, the affordable repayment plan for student loan borrowers, known as SAVE, is also facing legal challenges that have put a halt on payments for enrollees. With the 2024 presidential election on the horizon, the administration’s efforts to deliver relief to borrowers have hit roadblocks, leaving many to question the motives behind the opposition. As the battle over student loan forgiveness wages on, the uncertainty surrounding the future of millions of borrowers remains a pressing issue that requires resolution.

Leave a Reply