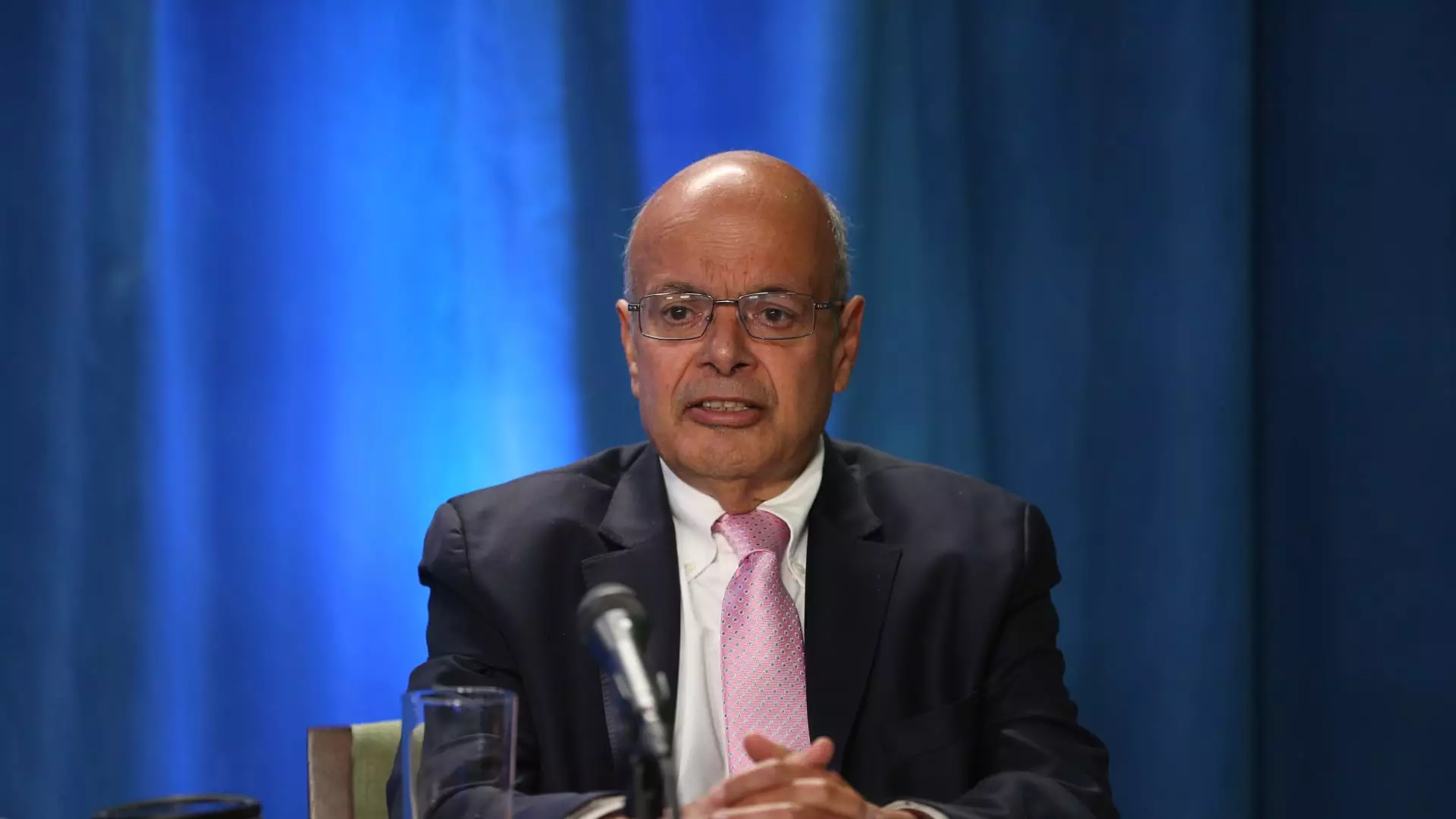

The recent sale of over half of Ajit Jain’s stake in Berkshire Hathaway has sent ripples through the financial and investment community. As Warren Buffett’s loyal lieutenant and the vice chairman of insurance operations, Jain’s decision to divest 200 shares—approximately 55% of his total holdings—has raised numerous questions and speculation regarding both his motivations and the future trajectory of the conglomerate he has helped to build since 1986.

Jain’s sale, executed at an impressive average price of $695,418 per share, amounts to about $139 million. Following this transaction, Jain’s personal holdings have dwindled to merely 61 shares, in addition to family trusts holding 55 shares and his nonprofit organization, the Jain Foundation, controlling 50 shares. Given Berkshire Hathaway’s recent surge in stock price—exceeding the $700,000 benchmark and achieving a market capitalization of $1 trillion—Jain’s profit-taking actions may suggest a strategic acknowledgment that shares are currently valued at an all-time high.

Industry analysts have noted that Jain’s decision appears to signify a cautious perspective on Berkshire Hathaway’s future valuation. Observers like David Kass, a finance professor at the University of Maryland, argue that Jain’s move could be interpreted as a signal that he considers Berkshire to be fully valued at this time. This notion is bolstered by a notable slowdown in the company’s share buyback activity, with a stark contrast shown in the second quarter, where only $345 million of its own stock was repurchased compared to the $2 billion buybacks in previous quarters.

Bill Stone, the Chief Investment Officer at Glenview Trust Co., reiterates this sentiment, commenting that with shares priced around 1.6 times book value, the stock is likely trading close to Buffett’s conservative estimates for its intrinsic value. Such observations prompt speculation regarding the likelihood of additional buybacks under these conditions, while also potentially reflecting Jain’s assessment that the market may not offer attractive entry points for future investments at present.

Ajit Jain’s significance to Berkshire Hathaway cannot be overstated. His impactful leadership and strategic vision have facilitated an expansion into reinsurance markets and driven the revitalization of Geico, a keystone segment of the company’s vast portfolio. His contributions have earned him favorable remarks from Buffett, who has acknowledged Jain’s ability to create substantial shareholder value.

Despite speculation regarding Jain’s possible succession in the hierarchy of Berkshire’s leadership, Buffett recently clarified that Jain has never expressed a desire to take over the reins of the conglomerate. This context frames Jain’s recent stock sale as not just a personal financial maneuver, but also an operation embedded within a broader spectrum of strategic planning for Berkshire’s leadership structure and operational strategy.

For Berkshire Hathaway investors and stakeholders, Jain’s selling pattern might be interpreted as an inflection point. While some may view this as a cue to adjust their positions, others may remain steadfast in their belief of the long-term soundness of the conglomerate’s business model under Buffett’s enduring guidance. The occurrence invites investors to contemplate not only the ramifications of individual actions from leading executives but also the wider implications of market valuations in the context of long-term investment strategies.

As the investment landscape continues to evolve, the steps taken by key figures like Ajit Jain may serve as critical indicators of market positioning and the future direction of significant institutional players. Whether this sale represents a temporary reaction to market conditions or a more profound reconsideration of investment fundamentals remains to be seen, but it certainly warrants close attention from the financial community in the months and years to come.

Leave a Reply