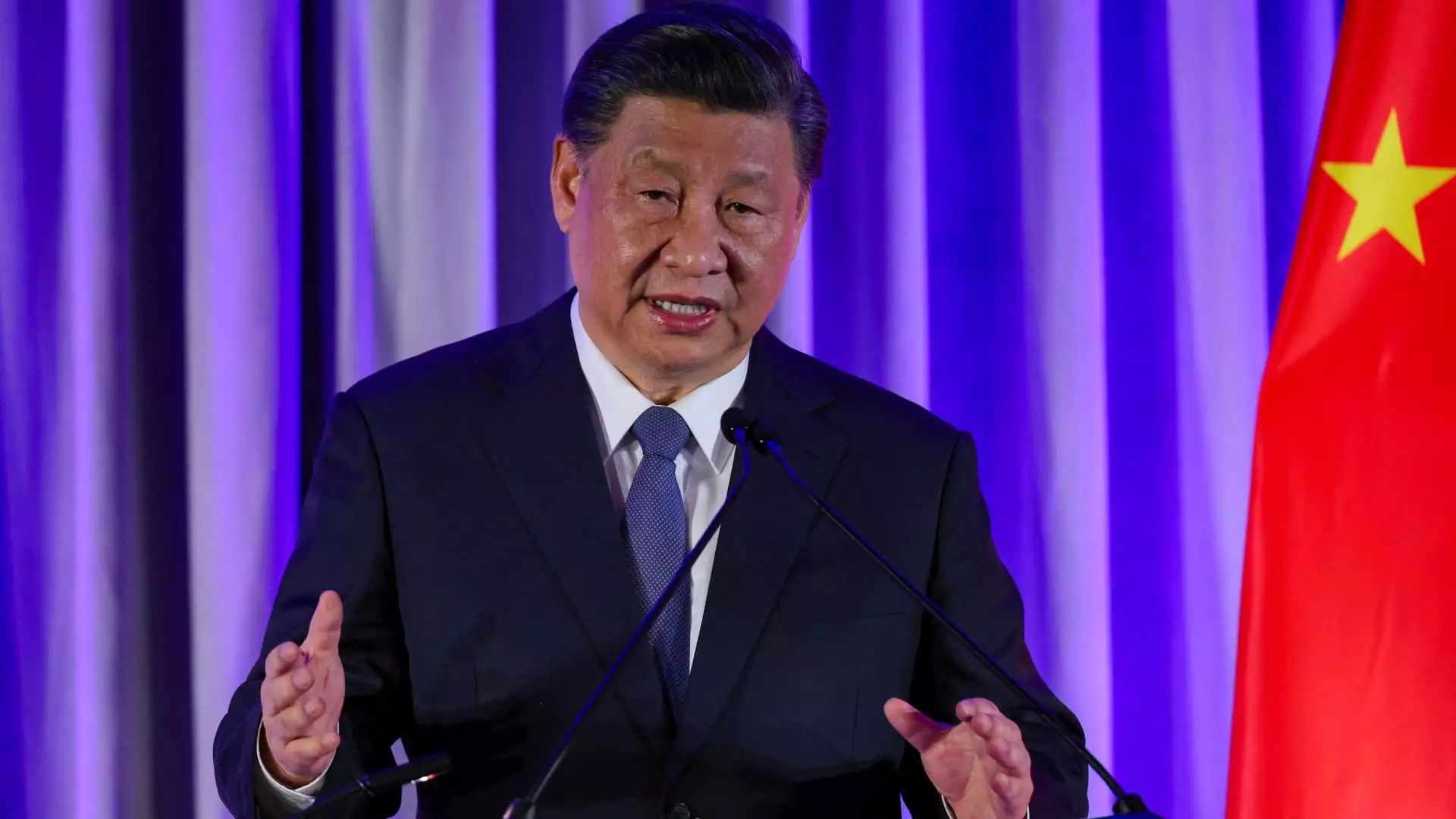

In recent developments, Chinese political leadership has signaled an urgent commitment to reversing the ongoing slump in the real estate sector, a crucial pillar of the nation’s economy. Following a high-level meeting led by President Xi Jinping, state media disseminated a readout emphasizing the need for immediate actions to stabilize the faltering real estate market while addressing the public’s concerns. This initiative comes amidst broader discussions on economic resilience and recovery, highlighting the interconnectedness of real estate with employment and demographic challenges, particularly an aging population.

Real estate has historically been a significant driver of China’s economic growth, constituting over a quarter of GDP. However, the sector has faced relentless challenges since the government’s crackdown on excessive debt among property developers in 2020. The resulting downturn has not only impacted property values but has also restricted local government revenues and diminished household wealth, leading to a more tempered economic outlook. There exists widespread skepticism regarding China’s ability to achieve its GDP growth target of about 5%, fuelling the demand for stimulating measures to rescue the economy from stagnation.

Reports of the Politburo meeting triggered a surge in stock markets, with significant gains recorded in mainland China and Hong Kong. Chinese property stocks experienced notable rises, indicative of renewed investor confidence driven by the prospect of fiscal and monetary policy interventions. While this reflects a positive market sentiment, it must be tempered with caution, as the broader economic stability remains precarious, underscoring the necessity for substantial fiscal support beyond mere policy announcements.

The readout from the Politburo indirectly outlined a framework for potential intervention that includes curtailing housing supply, expanding loan availability for select development projects, and lowering interest rates on existing mortgages. These measures are critical steps towards alleviating the financial strain on homeowners and helping stimulate consumer confidence in the housing market. Economic analysts, such as Zhiwei Zhang from Pinpoint Asset Management, view these initial steps as a foundational move towards a more comprehensive fiscal strategy, albeit acknowledging the time needed for such a package to materialize effectively.

Data from recent months indicates that, while the decline in real estate value has somewhat moderated, substantial challenges remain. Figures show a 23.6% drop in new home sales over the year ending in August, slight improvements notwithstanding. The slow recovery suggests that households remain hesitant to invest in real estate, exacerbating the ‘wait-and-see’ mentality that impedes market recovery.

Policymakers appear to recognize the delicate balancing act required between stimulating immediate economic growth and addressing underlying structural issues in the economy. Although the directives from the recent meeting reflect a commitment to stabilize growth, they also imply a strategic pivot away from aggressive expansion towards a more measured approach. Analysts, including those from Goldman Sachs, have adjusted their growth projections downward in light of the evolving economic landscape, hinting at a potential acceptance of growth rates slightly below 5%.

This shift illustrates a broader understanding among Chinese leadership that the nation’s economy must transition towards a model focused on higher quality and sustainable growth, particularly with the increasing influence of high-tech industries. As noted by experts such as Bruce Pang from JLL, this restraint signals policymakers are adapting their tactics to acknowledge a more gradual rebalancing of economic expectations.

China’s commitment to rectifying the real estate crisis underscores a critical moment for its economy. The Politburo’s recent meeting not only reflects an understanding of current economic vulnerabilities but also an aspiration to engender stability through measured policy adjustments. For stakeholders, the implications extend beyond the real estate sector, influencing household consumption and broader economic health.

As the government develops more detailed policies aimed at stimulating the property market, continuous vigilance will be required to assess the efficacy of these measures. The pathway to recovery will likely hinge on the capacity of policymakers to encourage consumer confidence and a willingness among households to engage with the housing market once more. Ultimately, the balance between short-term gains and long-term structural reform will define the journey ahead for China’s economic landscape.

Leave a Reply