Warren Buffett, the renowned CEO of Berkshire Hathaway, has recently altered the contours of his investment strategies in a notable way. For the fourth consecutive quarter, Buffett has reduced his stake in Apple Inc., a company that has been a cornerstone of Berkshire’s investment portfolio for several years. As of the end of September, Berkshire Hathaway’s holdings in Apple are valued at an impressive $69.9 billion, a staggering drop of 67.2% compared to the same time last year. This reduction signifies a significant departure from Buffett’s earlier strategy, raising questions about what could be fueling this intriguing trend.

Buffett’s decision to continuously offload Apple shares reflects a broader reassessment of market valuations and portfolio concentration risk. When Berkshire first acquired Apple, it occupied a substantial portion of the equity portfolio, nearly half at its peak. Such a concentration in a single stock can expose an investor to unnecessary risk, particularly in volatile market conditions. Analysts propose that Buffett might be reacting to this imbalance by deliberately diversifying his investments, effectively minimizing exposure to potential downturns specific to the technology sector.

Furthermore, the evaluations of Apple shares themselves have sparked debate among investors and analysts alike. The tech giant has traditionally commanded high valuations, and the recent sell-offs could indicate skepticism about maintaining those levels, particularly in the face of economic uncertainty. Buffett’s approach to managing exposure aligns with his history of cautious optimism and long-term investment philosophy.

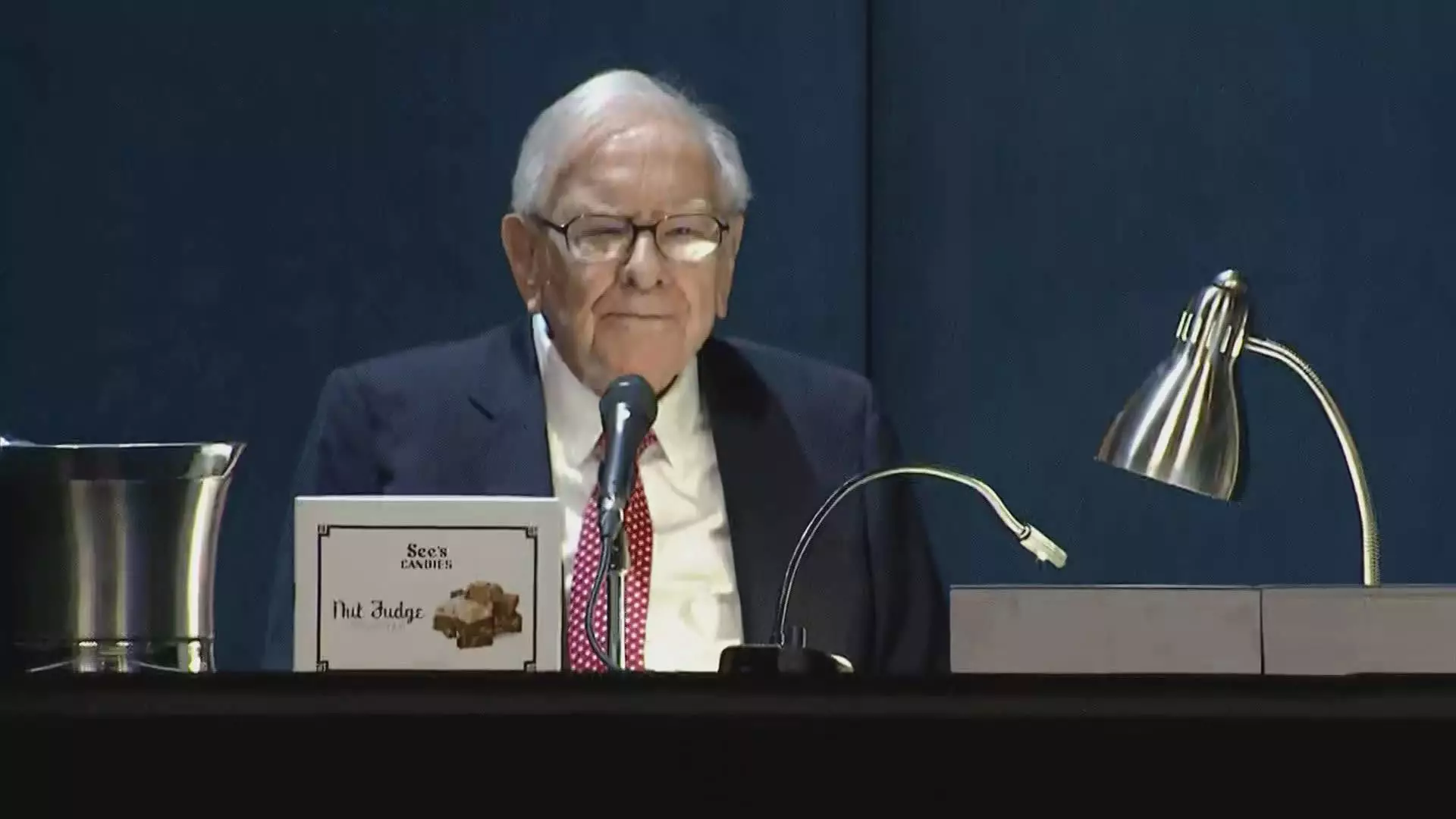

At the last Berkshire Hathaway annual meeting, Buffett hinted that his motivation for the divestiture could be linked to anticipated changes in tax legislation regarding capital gains. As fiscal deficits grow, potential tax hikes might be on the horizon, and this foresight could indeed play a role in Buffett’s selling spree. However, given the size of the recent sales, many speculate that there might be more to this narrative than simply tax considerations. Such aggressive divestiture suggests a pragmatic approach toward liquidity management in uncertain times.

With Berkshire Hathaway’s cash reserves soaring to an all-time high of $325.2 billion as of the third quarter, the company stands in a robust position to explore other investment opportunities, should the right conditions arise. The firm has also paused its buyback program, a strategic move indicating a possible shift in focus towards acquisitions and new ventures.

Buffett’s affection for Apple began in 2016, challenging the long-held notion that technology investments lay outside his competency circle. His recognition of Apple’s loyal customer base and the sustained relevance of its products accelerated the growth of his stake in the company. However, as the market evolves, so do the strategies of seasoned investors like Buffett. His recent actions underscore a fundamental truth of investing: adaptability is crucial.

As Apple shares exhibit an increase of 16% year-to-date, they remain overshadowed by the S&P 500’s 20% gain. This disparity may reshape the outlook for individual investors considering similar positions. In the end, Buffett’s methodical retreat from Apple could serve as a playbook for navigating the complexities of the modern investment environment—where volatility and opportunity coexist in an ever-changing landscape.

Leave a Reply