AppLovin, a notable entity in the online gaming and advertising landscape, recently witnessed its shares skyrocket by 45% following the release of its impressive third-quarter earnings report. This remarkable surge was propelled by a constellation of factors, including financial guidance that significantly exceeded Wall Street’s predictions, along with better-than-expected performance metrics in both earnings and revenue. As a result, the stock price soared past $245 by early afternoon trading, underscoring a staggering rise of 515% year-to-date, thereby outstripping competitors in the tech sector, particularly those with market caps exceeding $5 billion.

AppLovin reported a 39% increase in revenue, reaching $1.2 billion, surpassing the anticipated $1.13 billion. Additionally, the company’s proclaimed earnings per share hit $1.25, a considerable improvement over the average forecast of 92 cents. For the fourth quarter, AppLovin projected revenue between $1.24 billion and $1.26 billion, translating to a prospective growth rate of approximately 31%. Analysts had previously estimated about $1.18 billion, highlighting a robust growth trajectory for the company.

What sets AppLovin apart, however, is its innovative approach to online advertising. While its gaming unit has experienced slower growth, it is the company’s advertisement division that has become a real powerhouse, thanks to advancements in artificial intelligence. The release of the updated AXON 2.0 advertising engine has positioned AppLovin at the forefront of ad targeting technology, driving substantial growth. In the third quarter, revenue from its software platform soared by 66% to $835 million, underscoring the efficacy of the AXON platform in delivering targeted ads.

Profit Margins That Impress the Market

Wall Street has taken note of AppLovin’s profitability as much as its revenue growth. The company’s net income surged by an astounding 300% year-over-year, amounting to $434.4 million or $1.25 per share, a significant rise from the previous year’s $108.6 million or 30 cents per share. The adjusted profit margin for the software platform stood at an impressive 78%, inviting further optimism from investors. Analysts, including those from Wedbush, have acknowledged this exceptional performance and have raised their price target for the stock from $170 to $270, recommending a buy.

Vision for the Future

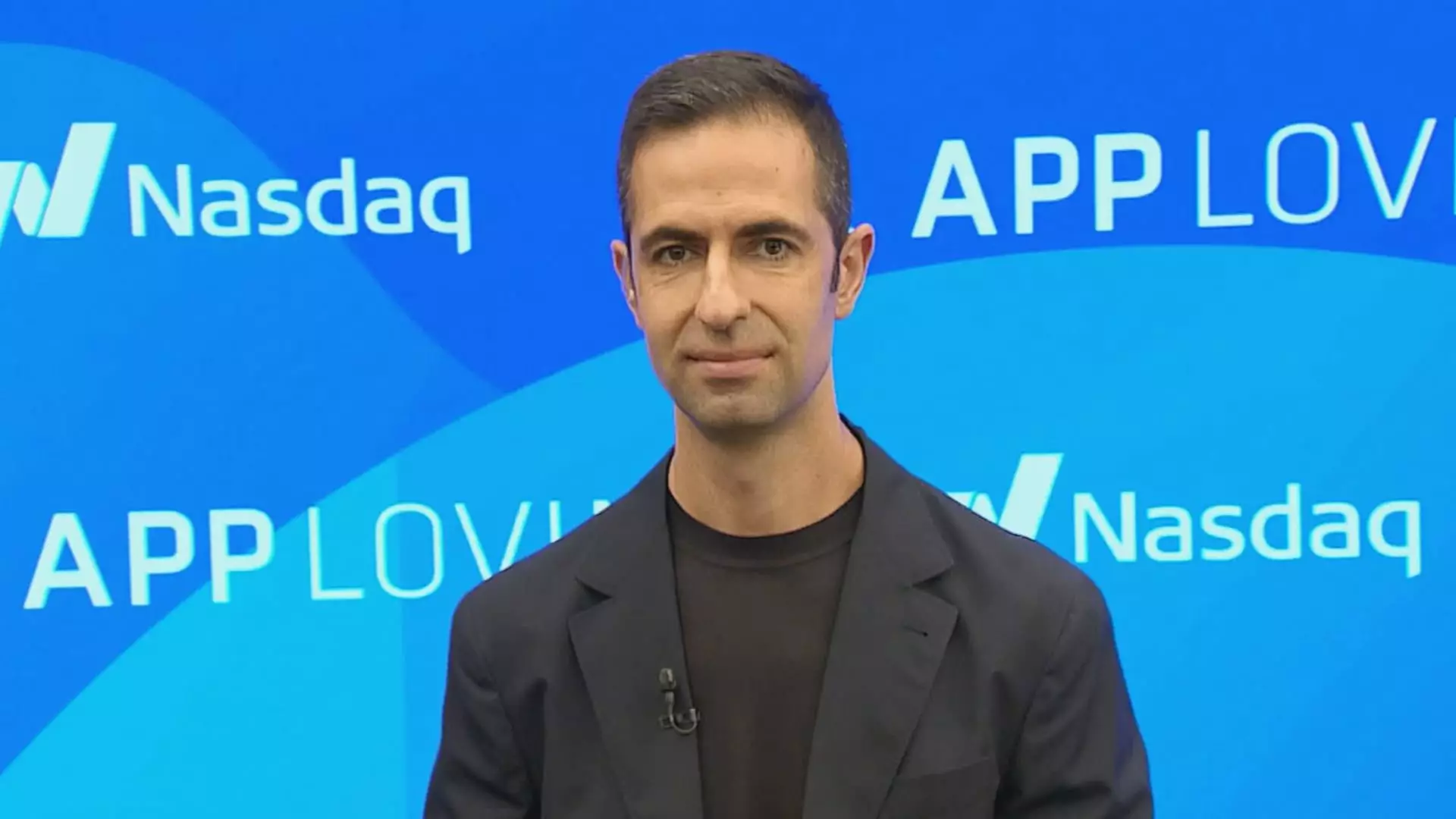

CEOs often bear the brunt of scrutiny, and Adam Foroughi is no exception. However, he recently reported a notable uptick in his personal wealth by $2 billion, soaring to approximately $7.4 billion. Foroughi also hinted at an exciting pilot project related to e-commerce technology, which is aimed at integrating targeted ads within games. According to him, this is one of the most promising initiatives the company has ever launched, although it remains in its testing phase.

AppLovin’s extraordinary rise in shares can be attributed to a blend of favorable market conditions, innovative technologies, and a robust commitment to profitability. As it navigates the complexities of both online gaming and advertising, the direction it takes in enhancing and diversifying its offerings will be crucial in sustaining investor excitement and market growth. With all these dynamics at play, the coming quarters shall reveal whether AppLovin can maintain its meteoric trajectory or if it will face hurdles in an ever-evolving tech landscape.

Leave a Reply