The recent announcement of Billy Long as the nominee for the Internal Revenue Service (IRS) leadership has sparked a multitude of responses from political factions and various stakeholders in the tax community. With President-elect Donald Trump aiming to reshape the federal agency, it is essential to analyze the potential impacts of this nomination, the background of Long, and the contentious issues surrounding his appointment.

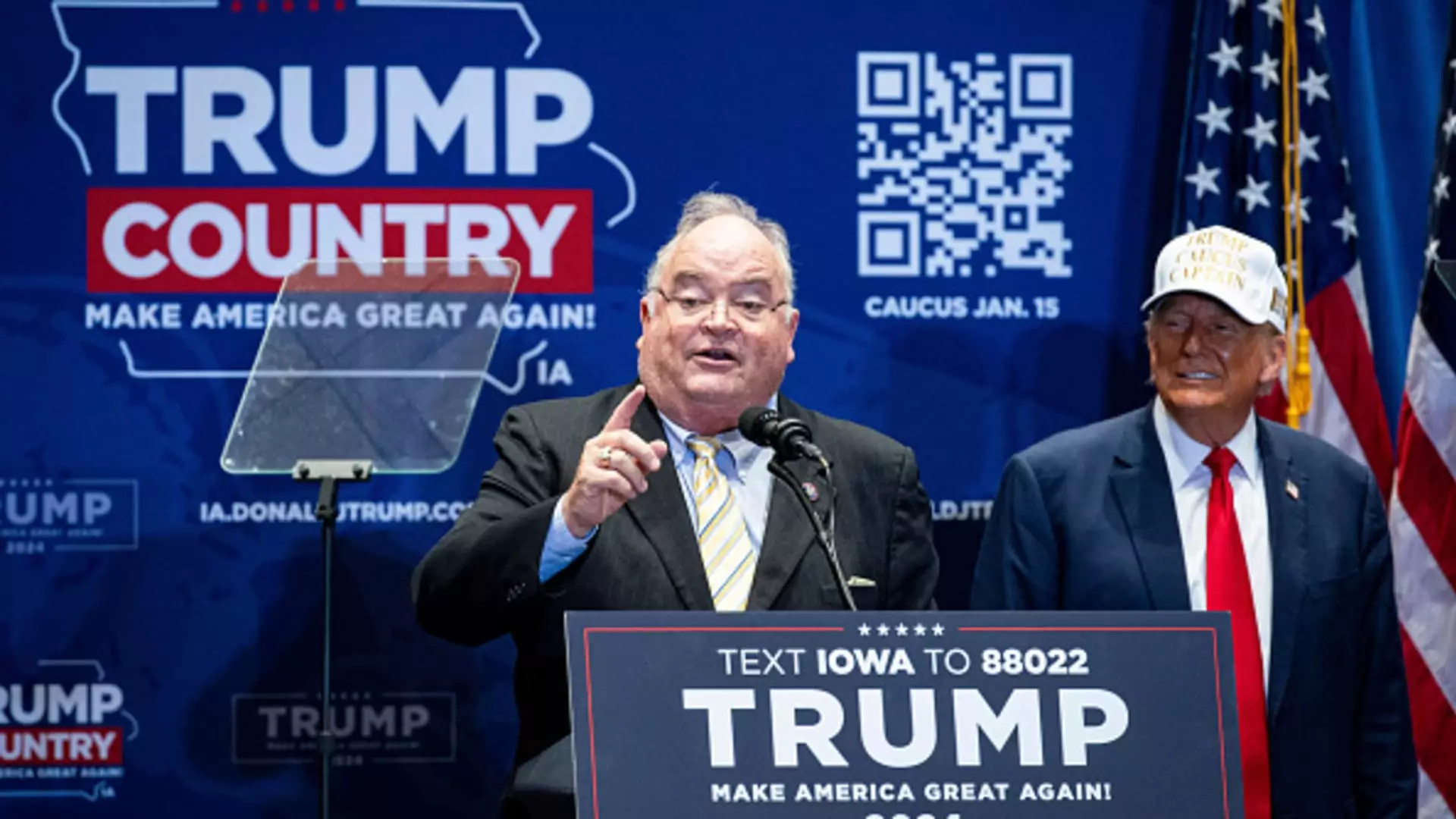

Billy Long, a former congressman from Missouri, brings a unique blend of experience to this role. Previously serving six terms in the U.S. House of Representatives from 2011 to 2023, Long has cultivated a public profile that intertwines politics with a background as an auctioneer and a business and tax advisor. This perspective, according to Trump, provides Long with a nuanced understanding of the IRS from both a taxpayer and a regulatory standpoint. Trump’s confidence in Long was clear from his remarks suggesting that both taxpayers and IRS employees would benefit from his leadership.

While this background may lend Long instant credibility among certain Republican circles, critics argue that his post-congressional activities, particularly involving the Employee Retention Tax Credit (ERTC) industry, may draw skepticism. The ERTC was instituted as a relief measure during the pandemic, but it has since faced scrutiny for purported misuse, raising red flags about potential conflicts of interest that could cloud Long’s judgment if confirmed.

The IRS is currently undergoing a significant transformation, boosted by a nearly $80 billion funding approval from Congress in 2022. This funding aims to modernize the agency’s technology, improve customer service, and broaden its enforcement capabilities, especially against high-income earners and large corporations. The nomination of Long signals the potential for a shift regarding the direction and execution of these reforms. Given Trump’s mixed record regarding the IRS, it is plausible that Long’s leadership could either reinforce ongoing efforts or redirect focus entirely, particularly considering the Republican Party’s criticisms of what it perceives as excessive IRS enforcement.

A pivotal concern for many will be Long’s stance on the accountability and transparency of the agency. Opinions remain divided on whether Long’s ties to Congress will enable him to advocate effectively for IRS independence or if it may result in undue political influence steering agency priorities. The balance between effective enforcement and protecting taxpayer rights will no doubt be under scrutiny as discussions evolve around his suitability for the role.

Political Response and Controversy

Long’s nomination has elicited a polarized reaction among lawmakers, reflecting broader ideological divisions concerning fiscal policy and tax regulation. While Republicans like Senator Mike Crapo express support, emphasizing the need for a fresh approach to tackle inefficiencies within the IRS, Democrats have raised alarm bells. Senate Finance Committee Chair Ron Wyden characterized Long’s selection as “bizarre,” citing his involvement in a tax credit sector marred by allegations of exploitation. These entrenched partisan perspectives further complicate discussions surrounding Long’s capability to fulfill the role amid increasing scrutiny from various stakeholders.

Moreover, the potential effort to oust current IRS Commissioner Daniel Werfel has implications beyond agency operations. Werfel’s tenure began under President Joe Biden; thus, Long might be viewed as a target of partisan retribution rather than a focused choice aimed at fostering the agency’s vision. The disruptive nature of such leadership changes poses risks not only for continuous IRS operations but also for maintaining trust in the institution’s ability to function effectively amid the political fracas.

Billy Long’s nomination to the IRS brings with it the promise of a fresh perspective and the challenge of navigating a politically charged environment. As reforms to modernize the agency clash with the criticisms surrounding Long’s record, the question arises: Will he embody the change needed to restore confidence in the IRS, or will his appointment exacerbate existing divides? The coming confirmation hearings and subsequent actions will illuminate whether Long’s leadership will infuse the IRS with new energy or propel it into a more polarized existence within the landscape of American tax governance.

Leave a Reply