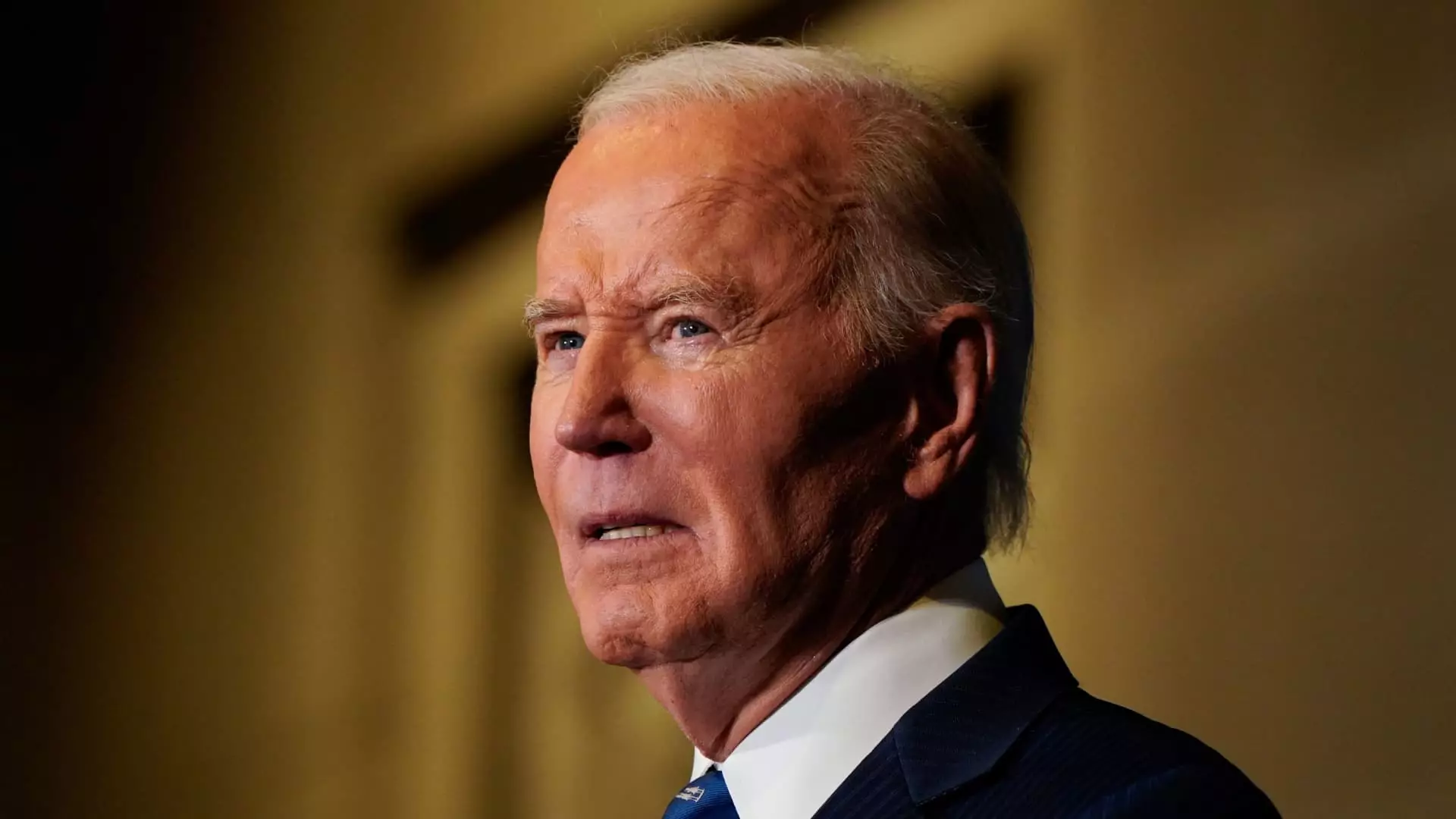

The withdrawal of two significant student loan forgiveness initiatives by the Biden administration has sparked considerable concern and disappointment among borrowers and consumer advocates. Originally designed to relieve millions of Americans from their education debt, these proposals aimed to support various groups struggling with their student loans. The abrupt change in policy, just weeks before the anticipated transition of power to President-elect Donald Trump, reflects both the tumultuous political landscape and the ongoing complexities surrounding student debt relief in the United States.

For several years, the issue of student loan debt has loomed large over the American economy. With outstanding student loans exceeding $1.7 trillion, millions of borrowers have been ensnared in a financial quagmire that has hindered their ability to achieve economic stability or growth. The Biden administration recognized these challenges and sought to implement solutions through various initiatives aimed at broad forgiveness of student loans. These latest plans were heralded as the “Plan B” after an earlier attempt was thwarted by a Supreme Court ruling in 2023.

However, as reported by the U.S. Department of Education, operational limitations prevented the implementation of these crucial regulations. The decision to retract the proposed rules highlights not only the administrative difficulties within the department but also the broader implications of governmental transitions on debt relief initiatives.

Key voices in the field of education finance have weighed in on the ramifications of these policy retractions. Mark Kantrowitz, a recognized expert on higher education, pointed out that the Biden administration was likely aware of the political barriers it faced with the incoming Trump administration, which has consistently expressed strong opposition to student loan forgiveness. Trump’s characterization of the initiative as “vile” and “illegal” raises questions about the future viability of any proposed debt relief efforts under his administration.

Consumer advocates have lamented the lost opportunity for relief, emphasizing that the proposals could have positively impacted millions of Americans burdened by student debt. Persis Yu, deputy executive director of the Student Borrower Protection Center, articulated the collective frustration, stating that the loss of these proposed policies effectively perpetuates the existing debt crisis that severely limits economic mobility for countless families and workers.

While the withdrawal of these ambitious forgiveness programs is disheartening, the U.S. Department of Education continues to offer various existing student loan forgiveness avenues. Programs like the Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness (TLF) remain available, providing crucial support for eligible borrowers. The PSLF program, for instance, offers loan forgiveness after ten years of qualifying payments for individuals employed in not-for-profit or government roles, while TLF assists teachers who serve in low-income schools.

Recently, the Biden administration announced an additional $4.28 billion in debt forgiveness under PSLF, benefiting around 54,900 borrowers. Such limited relief measures, however, stand in stark contrast to the comprehensive measures that were proposed, leaving many borrowers feeling anxious about their financial future and the potential for more expansive programs.

Despite the challenges ahead, experts advise borrowers to remain vigilant and informed about the existing relief options available. Platforms such as Studentaid.gov and resources like the Institute of Student Loan Advisors continue to provide vital information about student loan forgiveness programs that remain accessible to eligible borrowers.

The upcoming change in administrations is fraught with uncertainty for student loan borrowers. The fate of existing programs, as well as any potential future initiatives, will depend heavily on the political climate and legislative actions. As such, the burden of student loan debt will likely remain a critical issue in American society, necessitating a concerted effort from all stakeholders involved, including lawmakers, educational institutions, and advocacy groups, to seek viable solutions moving forward.

Leave a Reply