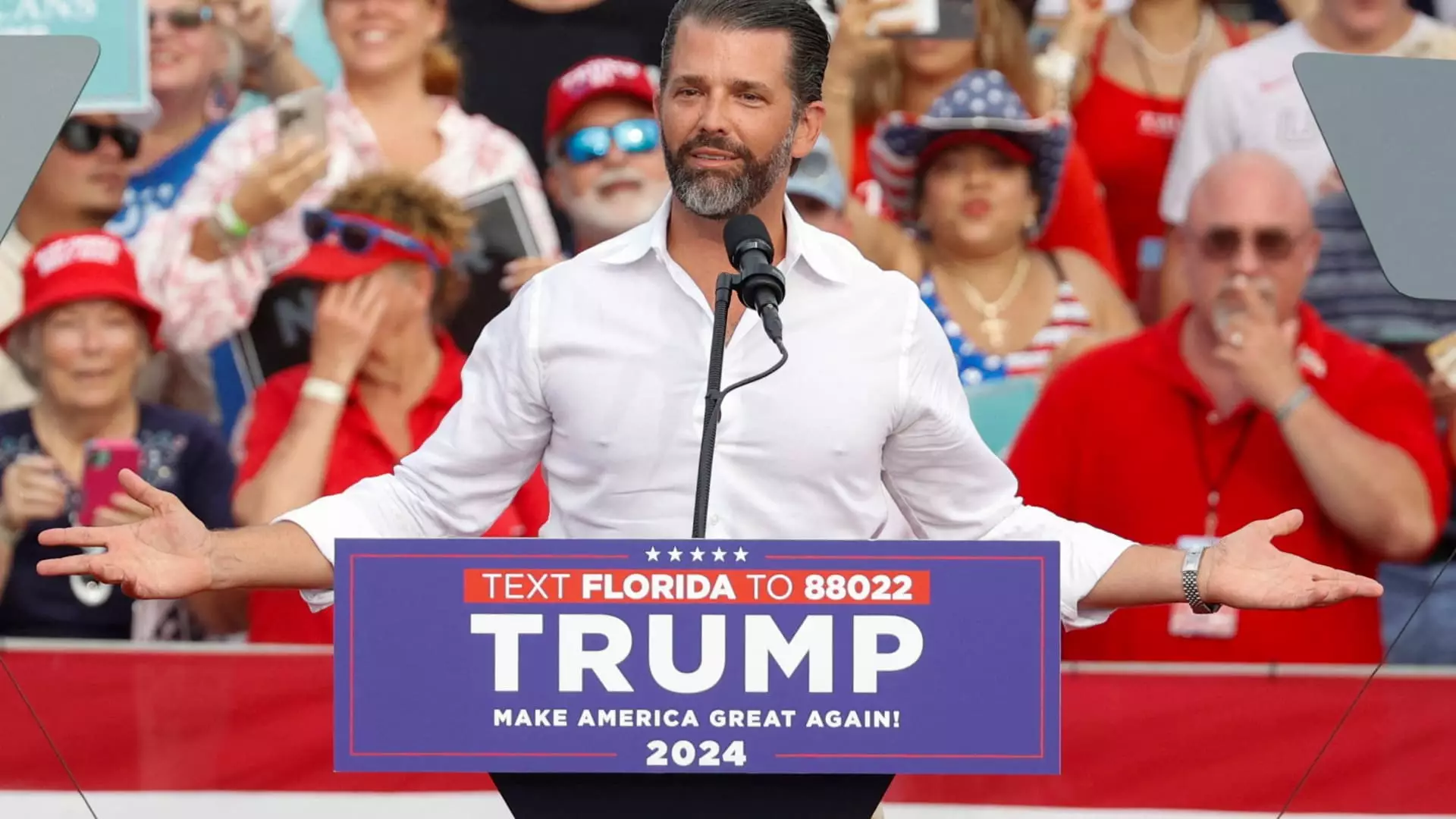

The announcement of Donald Trump Jr. taking a position on the board of PSQ Holdings has drawn significant attention, resulting in an extraordinary increase in the company’s stock prices. PublicSquare, the parent company of PSQ, focuses on commerce and payment solutions that align with values centered around family and liberty. Following the news, shares of PSQ Holdings soared by an impressive 185%, showcasing the unpredictable nature of microcap stocks and their sensitivity to high-profile endorsements.

PublicSquare is categorized as a microcap stock—valued at approximately $72 million at the close of trading just prior to Trump Jr.’s appointment. This financial backdrop highlights the potential volatility within such companies, which are often subject to rapid shifts influenced by political or celebrity endorsements. Trump Jr., known for his prominent political lineage, has a background in investment that complements his new role within PSQ Holdings. This move aligns with a trend where political figures leverage their influence in niche markets, specifically those that cater to conservative ideologies.

Despite the excitement surrounding Trump Jr.’s appointment, PublicSquare reported net revenues of only $6.5 million against substantial operating losses exceeding $14 million for the quarter ending September. These figures reveal a stark contrast between the potential market appeal of the company and its fiscal realities. The strategic direction, as referenced by both Trump Jr. and the CEO Michael Seifert, revolves around fostering a “cancel-proof” economy—a phrase suggesting resilience against the growing trend of social media-driven consumer boycotts. However, it remains to be seen how effectively this strategy will translate into long-term profitability.

Trump Jr. isn’t the only significant figure joining the ranks of emerging small enterprises. His recent affiliations with various companies—like his role at Unusual Machines, where shares surged 100% upon his announcement, and his partnership with 1789 Capital—indicate a trend where his presence alone can ignite investor interest. This trend points to the larger issue of how personal brand and political connections are leveraged in business contexts, especially among companies aimed at niche markets.

Ultimately, Donald Trump Jr.’s involvement with PublicSquare could symbolize both promise and peril for the company. While the surge in stock price is a promising sign of market enthusiasm and indicates a potentially strong brand alignment with patriotic values, the tangible outcomes remain uncertain. With foundational financial challenges to address, the board—now fortified with Trump Jr.’s experience and connections—faces the task of steering the company towards a more stable and profitable future. Investors, alike, should remain cautious yet hopeful as they navigate the complex interplay between politics, personal branding, and microcap market dynamics in the coming months.

Leave a Reply