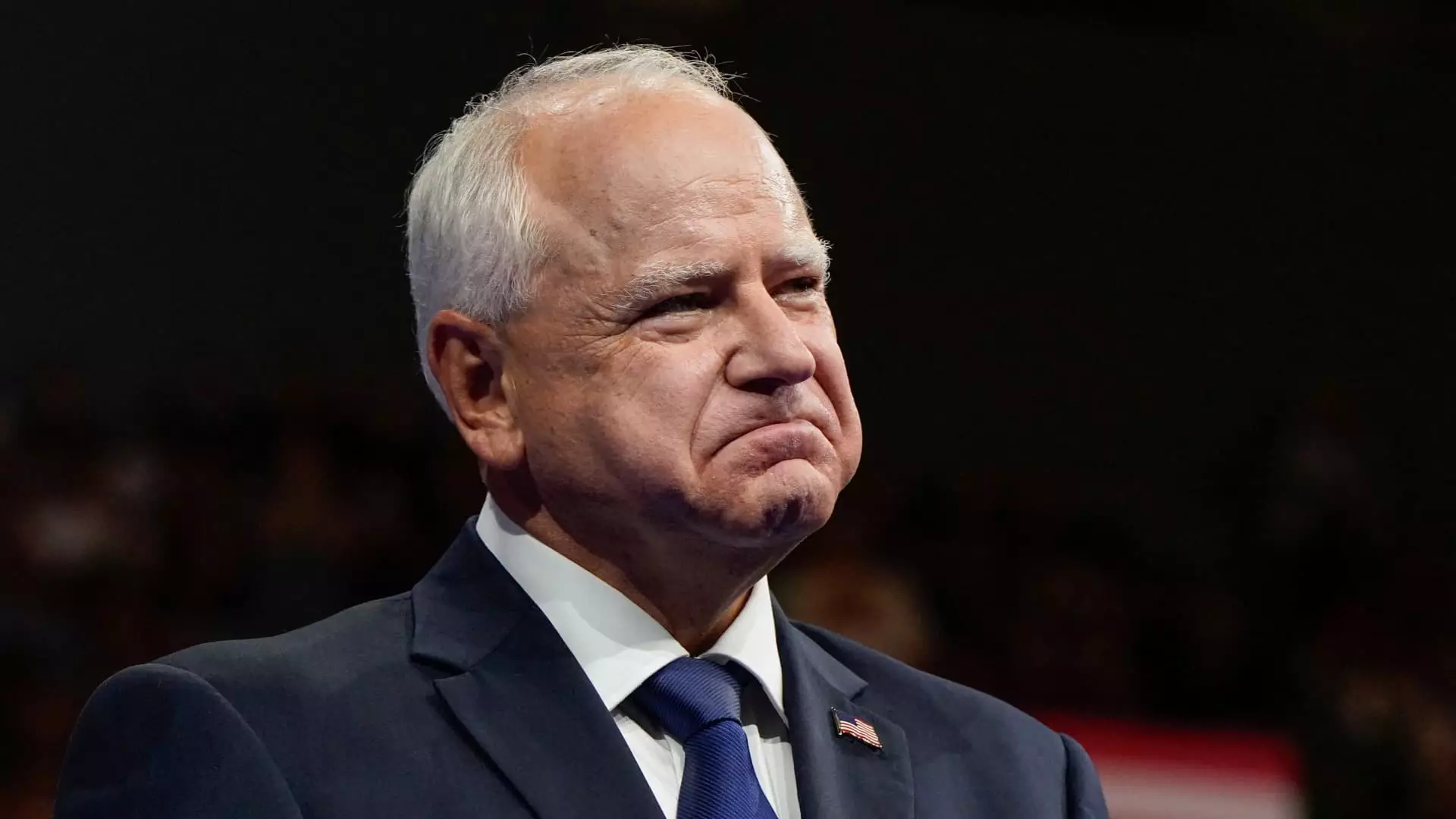

The proposal to exempt Social Security from income taxes has gained bipartisan support, with both federal and state initiatives being put forth to address the financial struggles faced by retirees. Former President Donald Trump has proposed a federal policy while Minnesota Gov. Tim Walz recently implemented state legislation in this regard. Despite the shared goal of providing relief to seniors, there are key differences in how these proposals would impact individuals based on political and fiscal considerations.

The Federal Approach

Under the federal income tax system, Social Security benefits are subject to taxation based on a recipient’s combined income, which includes various sources of earnings. The current rules stipulate that individuals with combined incomes above certain thresholds may have up to 85% of their Social Security benefits taxable. Approximately 40% of Social Security recipients currently pay federal income taxes on their benefits, according to the Social Security Administration.

Richard Auxier, a policy associate for the Urban-Brookings Tax Policy Center, has described Trump’s proposal as transformative, noting that it would have significant implications for both the cost and funding of Social Security. Estimates suggest that implementing this federal tax exemption could lead to a budget deficit increase of $1.6 trillion over a decade, potentially accelerating the insolvency of Social Security and Medicare trust funds.

The State Implementation

By contrast, Minnesota’s approach to exempting Social Security from state income taxes has been more targeted and limited in scope. The state expanded its tax exemption in 2023 to benefit seniors with adjusted gross incomes below certain thresholds, allowing them to subtract Social Security benefits from their earnings. This policy, which aligns Minnesota with other states that have similar exemptions, aims to reduce the financial burden on retirees without imposing significant costs on the state budget.

Jared Walczak, vice president of state projects at the Tax Foundation, has highlighted the distinct advantages of state-level tax exemptions for Social Security benefits. While Trump’s federal proposal could have broad implications for the national budget, state initiatives like Minnesota’s can be more tailored to specific demographic groups and economic conditions. Additionally, these state policies carry different revenue implications and can be implemented with less fiscal strain compared to federal proposals.

The debate over exempting Social Security from income taxes underscores the complexity of addressing financial challenges faced by retirees. While federal proposals like Trump’s may offer sweeping changes, state-level initiatives such as Minnesota’s provide a more targeted approach to alleviating tax burdens on seniors. As policymakers consider the impact of these proposals on funding streams and budget deficits, it is crucial to strike a balance between providing relief to retirees and maintaining the financial stability of entitlement programs. Ultimately, the effectiveness of these tax exemptions will depend on their ability to support aging populations while ensuring the long-term sustainability of Social Security and Medicare.

Leave a Reply