As trading kicked off in 2025, a palpable surge of investor optimism ignited financial markets, reminiscent of the speculative booms seen in years past. The initial trading session following a remarkable two-year run for the S&P 500 put many investors on high alert, yet excitement was the defining sentiment. The notable rally was driven by a blend of cryptocurrency gains and the resurgence of interest in previously underperforming meme stocks. Markets appeared to be catching fire, although the underlying catalysts remained elusive, creating a perfect storm for risk-seeking investors.

Cryptocurrencies demonstrated a remarkable bounce back, with Bitcoin reclaiming significant value and surpassing the $96,000 mark. This resurgence catalyzed stocks closely associated with the cryptocurrency sector, leading to impressive gains in firms like MicroStrategy, Coinbase, and Robinhood. MicroStrategy, having already exhibited remarkable performance throughout 2024 with over 360% gains, continued its ascent with a 3% increase on the first day of trading. Additionally, unusual tokens like “fartcoin,” which may have sounded like a mere joke, saw an astonishing 45% spike in value, illustrating the unpredictable nature of the crypto sphere which now boasts a market value exceeding $1.38 billion.

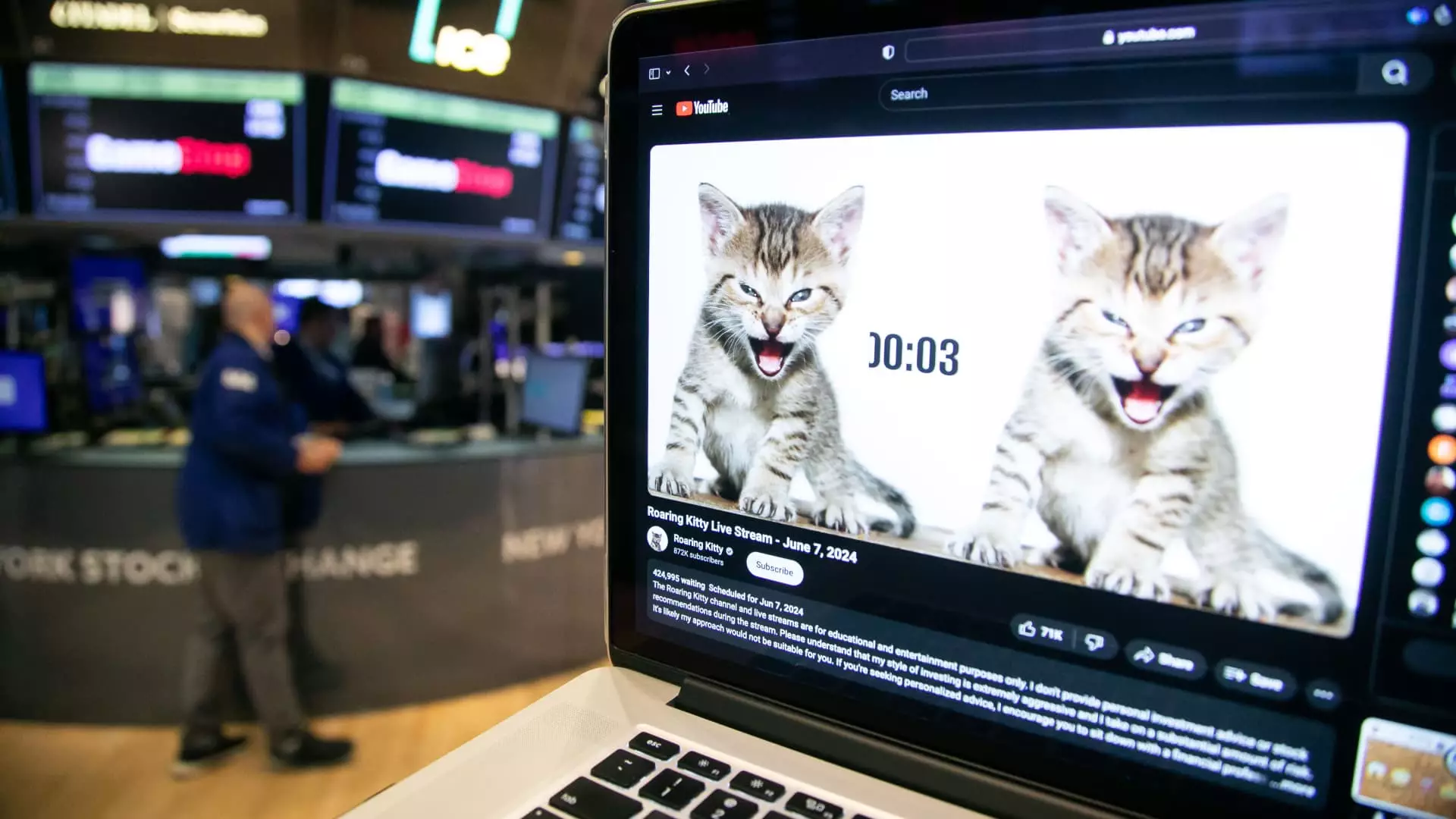

Central to this trading chaos was the impact of social media and the cult-like following of meme stock traders. One notable influencer, known as Roaring Kitty, once again piqued interest with a cryptic social media post that referenced a clip from Rick James. This sparked wild speculation among retail traders about the intentions behind the message. Many interpreted it as a nod to Unity Software, leading to an 11% surge in its stock, while others believed it hinted at a return to GameStop, a previous darling of the meme stock surge that also saw a modest bump. This dynamic highlights how swiftly information can spread and how sentiment can drive prices in ways that are often disconnected from traditional market fundamentals.

The phenomena surrounding these meme stocks embody a broader cultural phenomenon where traditional investment tactics get overshadowed by social media trends. Investors, particularly retail ones, are not only reacting to economic indicators but are also navigating the whims of online personalities and trends. The implication is clearer: the market is being shaped not just by financial data, but also by a digital social framework where sentiment can shift on a dime.

On a parallel track, the tech sector continued to demonstrate resilience, which played a significant role in supporting the market while concerns over the artificial intelligence trade simmered. Semiconductor manufacturers like Broadcom and Nvidia exhibited solid performances, with increases of 2% and 1.6% respectively on the same trading day. These stocks have become pivotal in the technology-driven narrative of economic recovery and innovation, lending credibility to the overall bullish sentiment despite looming worries.

Moreover, sectors traditionally less connected to the tech boom saw renewed attention. Topgolf Callaway Brands experienced an upgrade to “buy” from Jefferies, spurring an impressive 8.5% rise in its stock price. This movement affirms that optimism is not confined to tech alone but is spilling over into other markets, showcasing a broader spectrum of investor engagement.

Looking Ahead: Shifts in Market Sentiment

As the market embarked on this new chapter, nostalgia for previous rallies ignited debates about sustainability. The parallels drawn between current trading behaviors and the early days following Donald Trump’s electoral victory raise questions about the longevity of this optimism—especially amid apprehension regarding future economic policies and the potential implications of deregulation. The sentiment articulated by Morgan Stanley’s chief investment officer, Lisa Shalett, hinted at possible volatility as investors chase “animal spirits” in search of profits tempered by concerns around inflation and potential disruptions in supply chains.

Ultimately, the landscape for financial markets as 2025 unfolds is likely to remain tumultuous. While the excitement surrounding crypto gains, meme stocks, and tech sector rebounds is invigorating, the inherent unpredictability of these trends prompts caution. Investors must tread lightly, balancing hope against the possibility of market adjustments as the year progresses.

Leave a Reply