Reservoir Media has established itself as a prominent player in the music industry by building a comprehensive portfolio that spans music publishing, recorded music, artist management, and rights management, particularly in the Middle East. Divided mainly into two operational segments—Music Publishing and Recorded Music—the company’s structure allows it to maximize its revenue potential and diversify its income streams. As a music publisher, Reservoir acquires lucrative interests in various music catalogs, securing royalties from some of the most iconic songs in history. This includes esteemed works by artists such as Joni Mitchell and John Denver, alongside newer talents like Ali Tamposi and Oak Felder.

The Recorded Music segment involves a plethora of activities, including the discovery of new artists and the marketing and distribution of recorded music. The sector has proven to be vital for the company, generating a significant portion of its overall revenue. With over 150,000 copyrights and 36,000 master recordings under its belt, Reservoir Media stands out as a robust entity in an industry known for its volatility.

Despite its vast catalog and consistent growth, Reservoir Media has faced challenges in its stock market performance. As of now, the company’s market value sits at around $493.95 million, translating to approximately $7.59 per share; this figure, however, represents a noticeable decline of 22.24% since its introduction to the stock market via a SPAC merger in July 2021. Yet, the company’s financial metrics tell a more compelling story of resilience. Since its first earnings report, Reservoir has showcased substantial growth—gross profit increasing from $47.39 million to $89.38 million and EBITDA rising from $33.8 million to $54.4 million.

The Music Publishing segment has substantially outperformed expectations, accounting for approximately 66.41% of the company’s revenue—a testament to the substantial recurring revenue derived from subscription streaming and downloads. The increasing trend in streaming services, which have grown by 11.2% in 2023 and represent around 54.17% of Reservoir’s total revenue, underscores the strength of the company’s business model.

The emergence of activist investors like Irenic Capital highlights an evolving landscape for Reservoir. Founded by former finance professionals Adam Katz and Andy Dodge, Irenic has initiated calls for a strategic review of Reservoir’s operations, seeking to assess whether a sale or reorganization could maximize shareholder value. Holding an 8.14% stake in the company at an average cost of $6.54 per share, Irenic’s involvement underscores a broader concern regarding Reservoir’s public market positioning, particularly given the less-than-ideal price multiples currently afforded to the stock.

While the call for a strategic review may appear as a short-term tactic, it presents an opportunity for existing shareholders to reconsider the company’s long-term trajectory and potential exit strategies. Industry comparisons reveal that Reservoir is significantly undervalued; its trading multiples are less favorable when juxtaposed against peers who frequently command higher valuations—often in the mid to high teens.

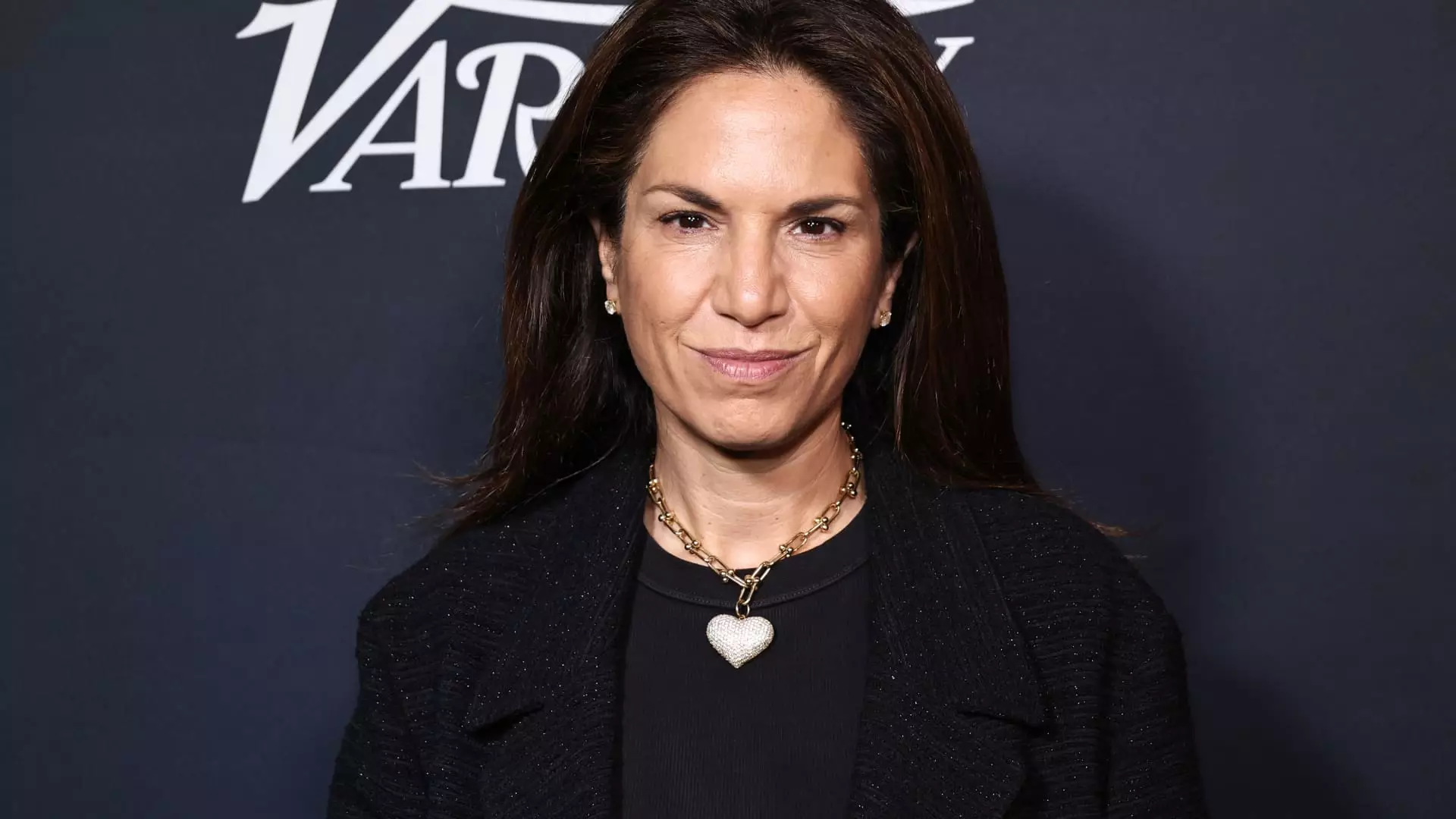

Given Reservoir’s current market dynamics, several scenarios could unfold in terms of acquisitions or buyouts. Notably, the Khosrowshahi family’s significant ownership stake complicates matters, as their 44% share represents a critical piece in any negotiations regarding buyout or acquisition strategies. The continued leadership of CEO Golnar Khosrowshahi—who has proven her capabilities in the industry—makes Reservoir an intriguing prospect for potential buyers.

In light of recent activity, such as Blackstone’s acquisition of peer Hipgnosis at a lucrative 18-times net publisher’s share, the foundation for a similar acquisition of Reservoir by a financial buyer becomes clearer. The consolidation trends within the music industry present a backdrop in which a strategic buyer could see great value in Reservoir’s extensive catalog and management team.

As Reservoir Media navigates the complexities of the current market landscape, the blend of internal strengths and external pressures presents both challenges and opportunities. While the financial community may be cautious, the continued demand for music catalogs remains robust, and the company’s mature assets offer a stable revenue base. Stakeholder engagement, particularly from activist investors, will play a critical role in shaping Reservoir’s strategic direction moving forward. Ultimately, Reservoir Media stands at a crossroads, and the decisions made in the coming months will determine its ability to thrive in an ever-evolving industry.

Leave a Reply