The Nvidia stock saga has been nothing short of a thrilling expedition for its investors, particularly over the past few years. As a frontrunner in the artificial intelligence (AI) sector, Nvidia’s market capitalization soared to dizzying heights. However, the stock’s unexpected fluctuations have raised concerns among analysts and investors alike as the company prepares to announce its quarterly earnings report.

Nvidia has undeniably been a key player in the AI revolution, substantially increasing its market cap by nearly nine times since late 2022, a staggering ascent that epitomizes the booming demand for AI technologies. At its peak in June, Nvidia briefly claimed the title of the world’s most valuable public company. This meteoric rise, however, came with its share of turbulence. Following its historic highs, the stock witnessed a steep decline, erasing approximately 30% of its value within a mere seven weeks. Roughly $800 billion in market cap evaporated during this downturn, leaving investors anxious about the company’s future trajectory.

Currently, Nvidia is experiencing a resurgence, with the stock inching closer to its all-time highs. However, the volatility has not gone unnoticed by Wall Street, particularly as the company gears up for its quarterly results. Investors are acutely aware that even a hint of declining AI demand or a tightening budget from a major cloud client might have severe implications for Nvidia’s revenue.

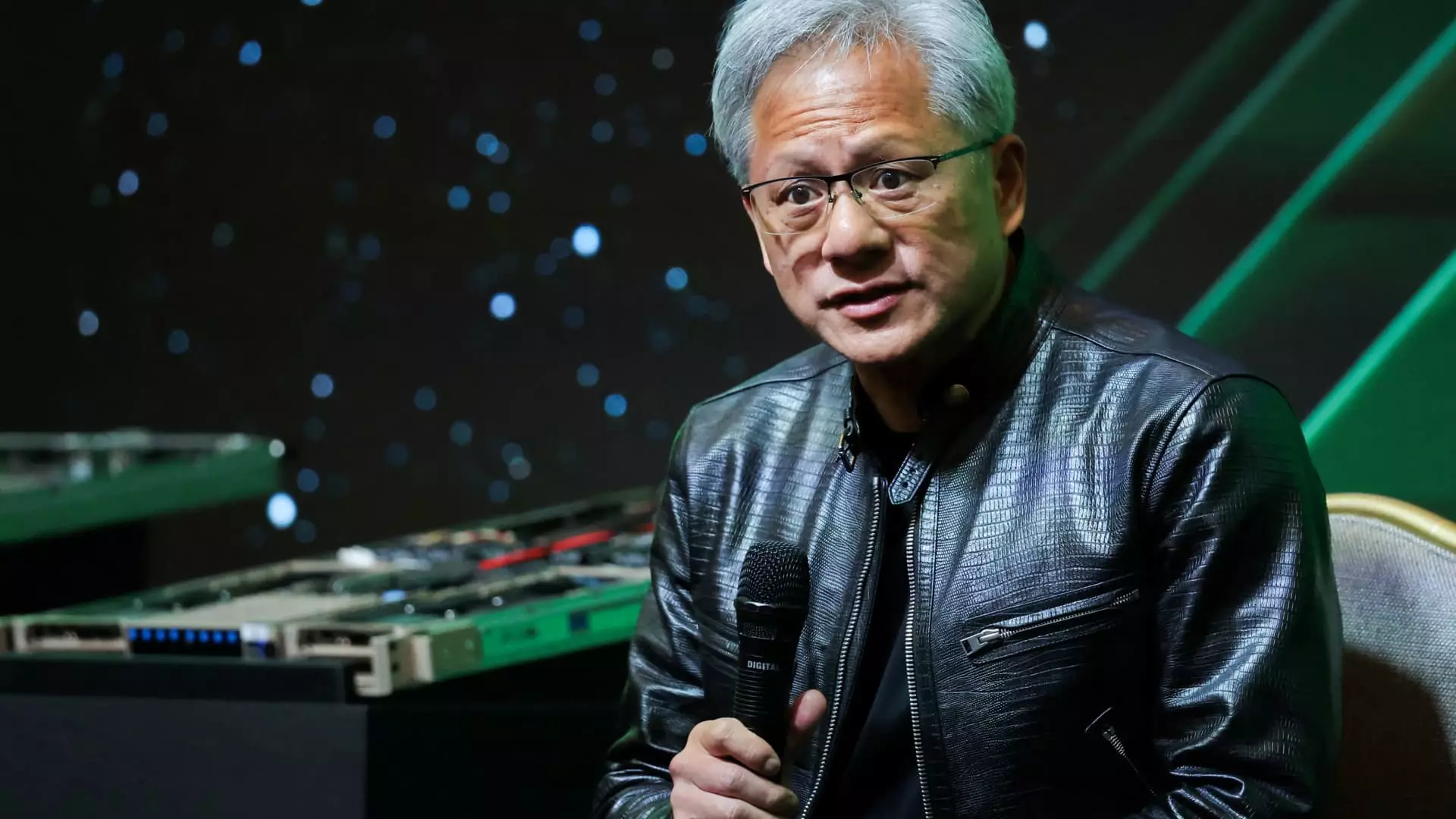

Eric Jackson of EMJ Capital aptly summarized Nvidia’s current standing, calling it “the most important stock in the world right now.” Given the broader implications of Nvidia’s performance on market sentiment, a disappointing earnings report could send shockwaves through the tech sector. Wall Street analysts are optimistic, expecting Nvidia to exceed expectations, especially in light of the growth trajectory that has characterized the company over the last several quarters.

As industry giants like Microsoft, Alphabet, Meta, and Amazon rely heavily on Nvidia’s graphics processing units (GPUs) for their AI-related operations, the sentiment on the earnings calls has increasingly referenced Nvidia as a central point of focus. This growing dependence underscores Nvidia’s pivotal role within the tech ecosystem. In the past three quarters, Nvidia has achieved annual revenue growth of over 300%, predominantly fueled by its data center division.

Analysts project that the company will report another quarter of impressive growth, albeit at a moderated pace, with expectations of a 112% increase in revenue. While the growth rate is impressive, subsequent quarters present a more challenging landscape with increased year-over-year comparisons, prompting investors to scrutinize the company’s performance closely.

As Nvidia approaches the anticipated earnings report, investors will be extremely attentive to the company’s growth projections for the upcoming quarter. Current forecasts suggest an expected revenue increase of about 75%, indicating a robust ongoing demand from its high-profile client base for AI infrastructure. Optimistic guidance could signal that the tech giants remain committed to significant capital investments in furthering their AI capabilities, while disappointing forecasts could indicate that the fervor for spending might be cooling.

Goldman Sachs analysts reflect this optimism, recommending a buy on Nvidia stocks while expressing concerns about the sustainability of the current capital expenditure trajectory from hyperscale clients. As technology companies continue to ramp up their AI initiatives, their continued willingness to invest significantly in Nvidia’s GPUs will be a critical indicator of the health of the AI market.

While the prospects for Nvidia seem bright, challenges loom on the horizon. Key questions arise regarding the long-awaited next-generation Blackwell chips amid reports of production delays that could potentially shift significant revenue into 2025. Nvidia had previously generated excitement with its optimistic revenue forecasts for the Blackwell series, yet production issues could introduce new uncertainties in its earnings outlook.

Despite these challenges, the existing Hopper chip series continues to dominate the market, particularly with the newer H200 iteration. Analysts suggest that demand remains strong for the current offerings, asserting that Nvidia may prioritize scaling production of Hopper chips in response to ongoing requirements from clients needing enhanced processing power for advanced AI applications.

Looking ahead, the overall sentiment surrounding Nvidia remains a mixture of excitement, caution, and contingency planning. With the tech industry standing at a pivotal moment in its AI journey, Nvidia’s strategic decisions and performance in the forthcoming earnings report will undoubtedly shape not just its future, but the broader landscape of the tech market as well.

While Nvidia has established itself as a central figure in the AI boom, its path forward hinges on effective management of its products, client relationships, and market positioning. Investors will be watching closely, as the resolution of uncertainty surrounding the company’s future could lead to new growth peaks or deepen the valleys of market volatility.

Leave a Reply