As Nvidia prepares to release its fiscal third-quarter earnings report, investors are keenly focused on the numbers, but even more on the future outlook that the semiconductor giant provides. The market consensus, as gauged by analysts from LSEG, is setting expectations at a revenue of $33.16 billion with an adjusted earnings per share (EPS) of 75 cents. While these figures are crucial for any quarterly report, it is Nvidia’s projections and insights about ongoing developments that truly matter to stakeholders. Investors are on the lookout for assurances that Nvidia can maintain its robust growth trajectory amid a rapidly evolving artificial intelligence landscape, which is now entering its third year.

The upcoming presentation is anticipated to shine a spotlight on Nvidia’s next-generation AI chip, Blackwell. This new offering is particularly significant as it is expected to bolster the company’s revenues through demand from major customers, including Microsoft, Google, and Oracle. Wall Street forecasts suggest Nvidia will project earnings of 82 cents per share and sales of $37.08 billion for the upcoming period, marking a pivotal juncture in the company’s growth strategy. The success of the Blackwell chip will not only reflect Nvidia’s position in the AI market but also showcase its ability to innovate and adapt to emerging challenges.

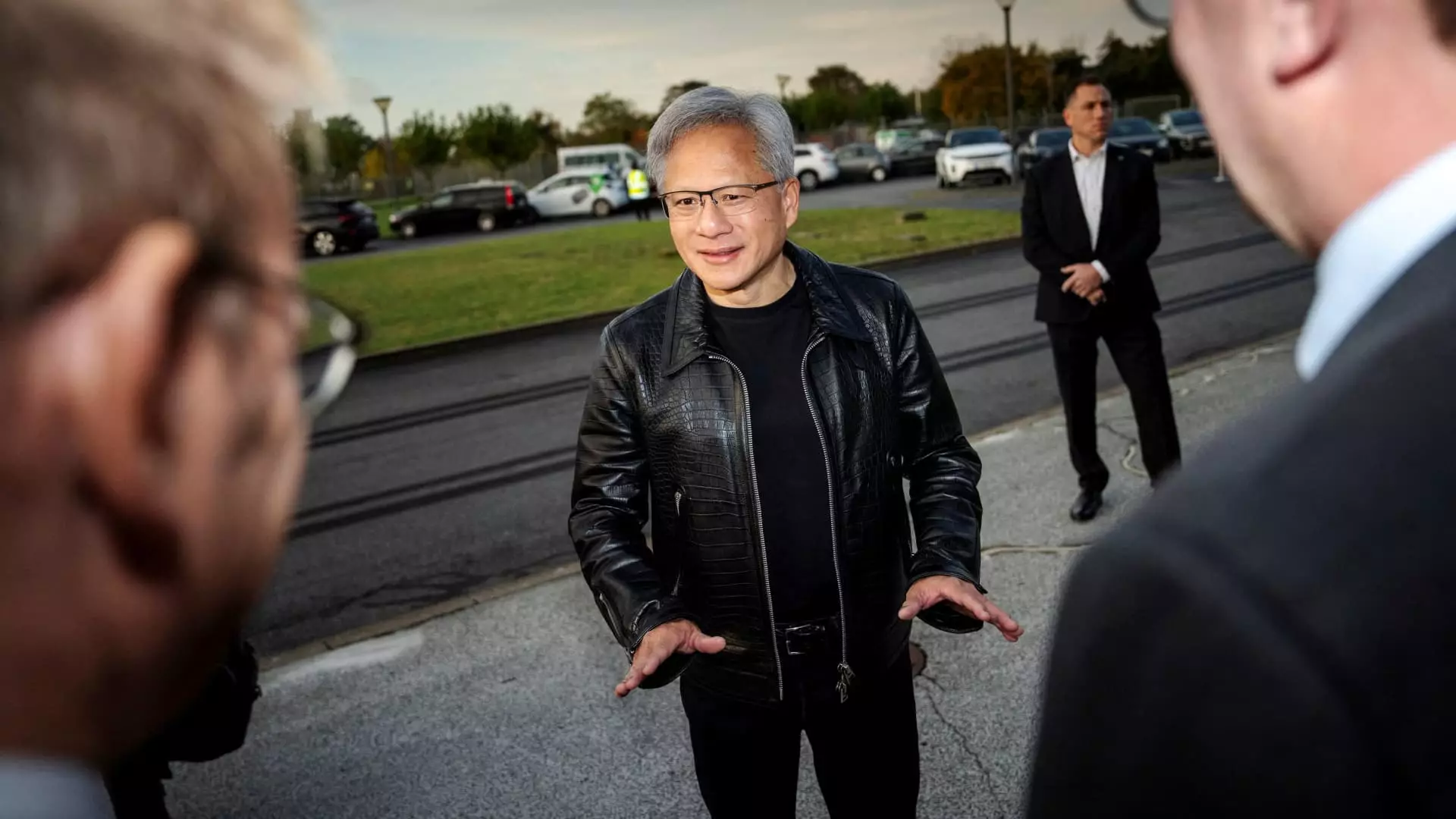

However, optimism surrounding Blackwell is tempered by reports of potential overheating issues in some systems utilizing these chips. This concern could impact product reputation and future sales if not addressed effectively. Investors will be closely monitoring comments from CEO Jensen Huang about demand and addressing these technical challenges. If Nvidia can communicate confidence in overcoming these obstacles, it could bolster investor sentiment and mitigate doubts regarding the longevity of its growth rate.

The stock performance of Nvidia since the beginning of 2024 has been nothing short of remarkable, with shares nearly tripling in value. This surge reflects a strong bullish sentiment among investors, buoyed by a reported 122% growth in sales in the last quarter. Yet, it’s worth noting that this growth represents a deceleration compared to earlier figures of 262% and 265% year-over-year growth in the previous two quarters. This slowdown raises questions about sustainability and the company’s ability to maintain momentum in a highly competitive environment.

As Nvidia stands at this crossroads, the upcoming earnings report is more than just a number-driven exercise; it is a critical moment for the company to reaffirm its position as a leader in the AI chip market. The outlook for Blackwell, the management’s handling of emerging challenges, and the sentiment surrounding Nvidia’s innovative capabilities will be pivotal factors in guiding investor expectations. Ultimately, how Nvidia navigates this delicate balance between promising growth and tangible obstacles will determine its path forward in a fast-paced technological arena.

Leave a Reply