As Nvidia continues to ride the wave of artificial intelligence (AI) advancements, its recent fiscal fourth-quarter earnings report reveals a complex picture of robust growth alongside emerging challenges. This article explores the details of Nvidia’s staggering performance, the dynamics affecting its business operations, and the outlook for the company as it transitions into 2025.

Nvidia’s fiscal fourth-quarter results, released on Wednesday, showcased an impressive revenue of $39.33 billion, surpassing Wall Street’s expectations of $38.05 billion significantly. Furthermore, adjusted earnings per share soared to 89 cents, exceeding the anticipated 84 cents. The financial figures reflect a fundamental strength in Nvidia’s core operations, particularly in the lucrative AI-driven data center sector.

The company has set ambitious guidance for the forthcoming first quarter, projecting revenues around $43 billion—an about-face from the prior year’s dizzying growth rate. This projection, indicative of approximately 65% year-over-year growth, underscores Nvidia’s confidence but also hints at a normalization following the hypergrowth seen in recent periods.

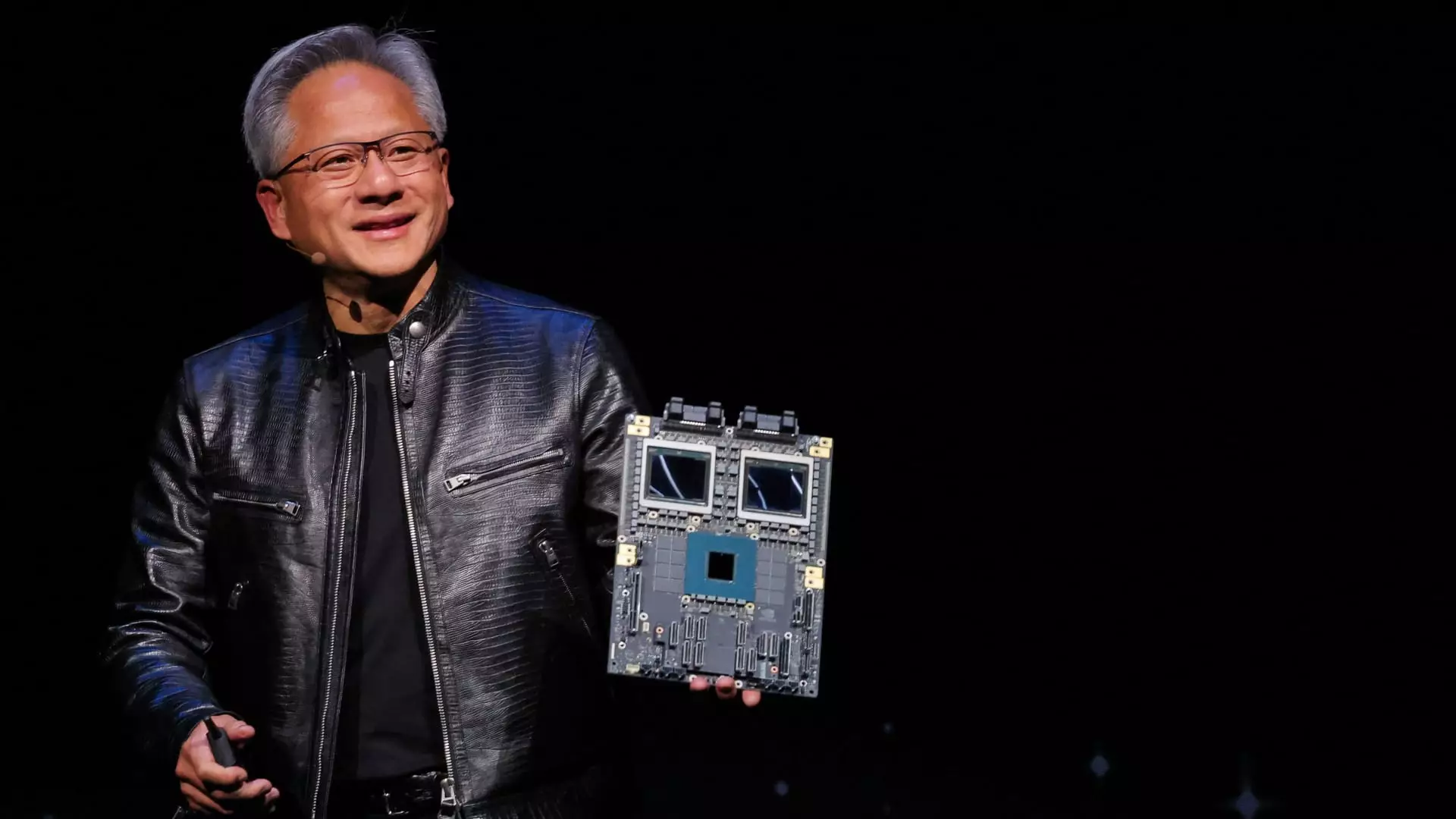

Central to Nvidia’s success is its pioneering AI hardware, notably the next-generation Blackwell chip. Chief Financial Officer Colette Kress indicated that sales of these new chips would ramp up significantly in the current quarter, pointing towards an unprecedented demand described as “amazing” by CEO Jensen Huang. Notably, Blackwell’s introduction is crucial in maintaining Nvidia’s standing as a leader in data center technology, which now constitutes an overwhelming 91% of the company’s total sales—a sharp rise from 83% just a year ago.

Despite these positive indicators, the drop in gross margins to 73% is concerning. This deterioration signals rising production costs and increased complexity associated with new product lines. Investors will closely monitor how Nvidia navigates this financial landscape as it balances innovation with cost management.

Nvidia’s revenue within its data center segment has skyrocketed approximately tenfold over the past two years, culminating in a staggering $35.6 billion for Q4. This growth is closely intertwined with the propulsion of large cloud service providers who account for nearly 50% of data center revenue. Observing this trend, Nvidia emphasizes that their new chips are designed not just for AI development but also for AI delivery—an evolution termed ‘inference.’ The implications of this shift are significant as it expands Nvidia’s potential application scope in AI.

However, Kress also raised critical points regarding competition, particularly from efficient models like DeepSeek’s R1, which could complicate future demand for Nvidia chips. Emerging AI models that require extensive computational resources for ‘long-thinking’ processes could amplify this need exponentially. This scenario underscores the intensifying competitive landscape in AI chip technology and the extent to which Nvidia will need to innovate to stay ahead.

While Nvidia’s growth trajectory is impressive, challenges loom in its established markets, particularly gaming. The gaming sector, contributing $2.5 billion in sales, fell short of expectations and exhibited an 11% decline compared to the previous year. The introduction of new graphics cards that incorporate the advanced Blackwell architecture may provide a short-term remedy; however, the gaming division’s performance raises questions regarding sustained engagement in a rapidly evolving market.

Moreover, amidst the pressure from competition, Nvidia’s networking segment reported a 9% decline from last year, countering earlier optimistic projections regarding its growth potential. This mixed performance could affect investor sentiment and the company’s overall market positioning.

Despite the challenges faced, Nvidia’s automotive segment is gaining traction—a small but significant area seeing a remarkable 103% year-over-year growth, amounting to $570 million in sales. This diversification into semi-conductors for vehicles and robots presents Nvidia with a valuable opportunity to leverage AI technology beyond traditional computing applications, adding a layer of resilience to its business model.

Additionally, Nvidia’s aggressive stock repurchase strategy, marked by $33.7 billion in the last fiscal year, reflects its commitment to returning value to shareholders during volatile periods.

Nvidia finds itself at a pivotal intersection, commanding a leading role in the booming AI chip market while facing traditional sector challenges. As the company continues to innovate and adapt, stakeholders will be keen on observing how its strategies unfold against the backdrop of fierce competition and an ever-evolving technological landscape. The future may hold greater prospects, provided Nvidia can strike the right balance between growth and operational efficiency.

Leave a Reply