Oracle Corporation has recently demonstrated an impressive performance in the stock market, witnessing a notable increase of approximately 6% in extended trading on Thursday. This uptick in share price follows the company’s announcement of raised fiscal 2026 revenue guidance, alongside an ambitious revenue forecast for fiscal year 2029. Analysts at the Oracle CloudWorld conference, held in Las Vegas, were informed that the company is now targeting a minimum of $66 billion in revenue for fiscal 2026, surpassing the consensus estimate of $64.5 billion set by analysts surveyed by LSEG. This marks a continuation of Oracle’s strong market momentum, as the stock has surged about 15% over the course of the previous three trading sessions, reaching record highs following a quarterly earnings report that exceeded expectations.

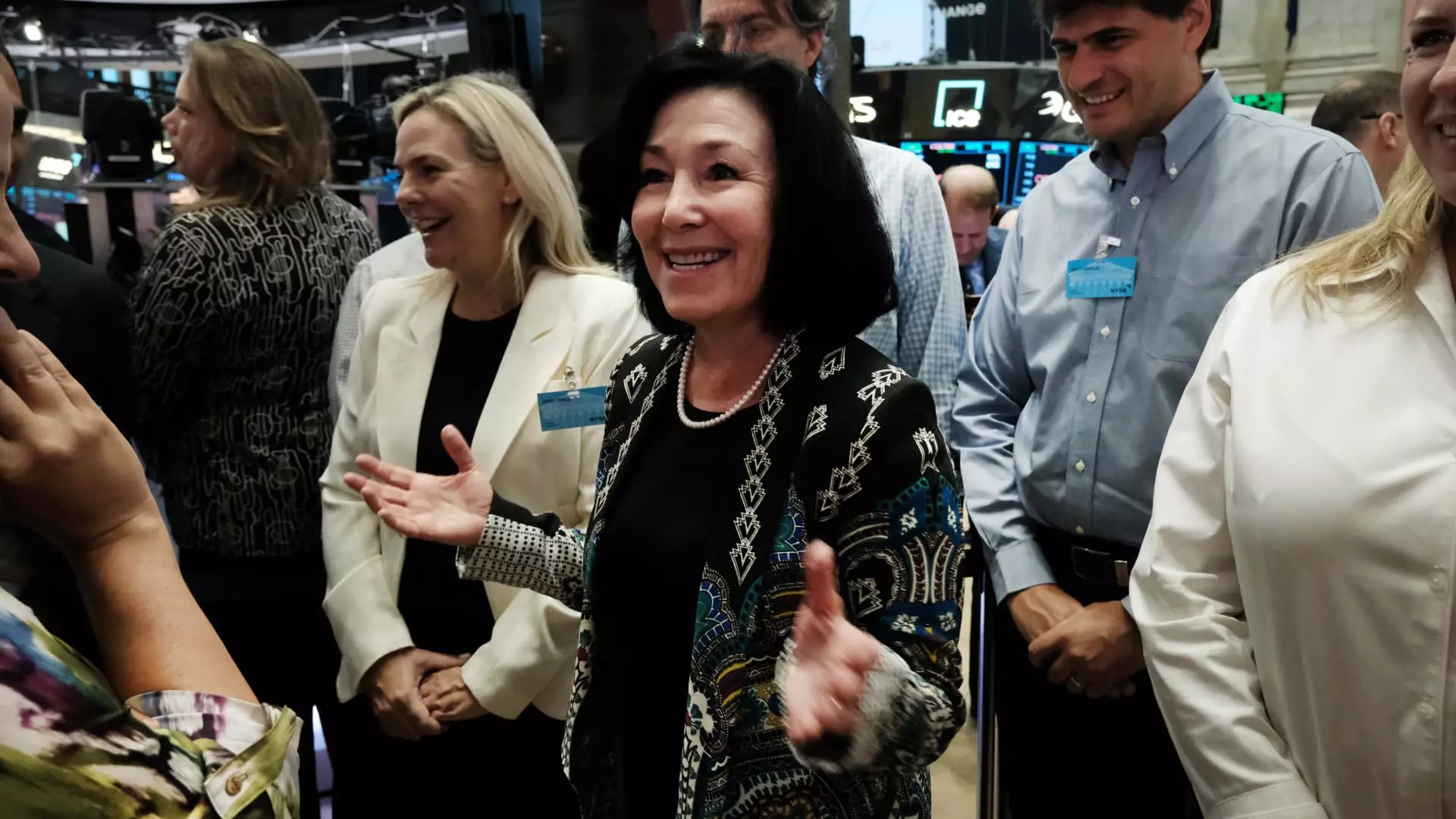

This sharp increase in Oracle’s stock price is part of a larger narrative of robust growth for the company, which has seen an impressive 55% rise in shares year-to-date. Notably, Oracle’s forecast for FY 2029 is particularly striking, as it anticipates revenues exceeding $104 billion while projecting a 20% year-over-year growth in earnings per share. Safra Catz, Oracle’s CEO, expressed confidence in meeting these ambitious targets, underscoring the company’s strategic partnerships with leading cloud providers, including Amazon, Google, and Microsoft. By expanding its distribution channels, Oracle aims to enable wider access to its database software, thereby enhancing its market penetration.

A critical factor contributing to Oracle’s optimistic revenue projections is the substantial growth in its cloud infrastructure division, which reported an impressive 45% growth in the most recent quarter. This growth trajectory positions Oracle favorably against major competitors like Amazon, Google, and Microsoft. The shift of corporate workloads to the cloud presents substantial opportunities for Oracle, as it capitalizes on the increasing migration of data centers to cloud-based solutions. Furthermore, Oracle’s foray into artificial intelligence has created additional avenues for expansion. The company recently announced its cloud unit had begun processing orders for a cutting-edge cluster of over 131,000 next-generation “Blackwell” graphics processing units produced by Nvidia.

In alignment with these aggressive growth strategies, Catz has indicated that Oracle plans to double its capital expenditures in the current fiscal year 2025. This strategic investment will support the company’s endeavors to enhance its cloud services and expand its AI capabilities, positioning Oracle to capture a significant share of the growing market. The focus on innovation and investment in technology infrastructure will likely play a crucial role in sustaining Oracle’s upward trajectory.

Oracle’s updated financial guidance, strong stock performance, and strategic plans underline its commitment to growth within an increasingly competitive tech landscape. As the company continues to secure partnerships with top-tier cloud providers and invest in AI technologies, it is well-positioned for a prosperous future, reinforcing its status as a formidable player in the technology sector.

Leave a Reply