Super Micro Computer, a key player in the server manufacturing sector, has found itself in a precarious position, as evidenced by a staggering 22% drop in its share price on Wednesday, marking the company’s lowest point since May of the previous year. This significant plunge underscores the mounting pressure facing the company amidst its failure to release detailed financial reports and its struggle to maintain compliance with Nasdaq listing requirements.

Financial Disarray: The Numbers Tell a Disturbing Story

As of early afternoon on Wednesday, Super Micro’s share price fell to $21.55, reflecting an alarming 82% decline from its mid-March peak of $118.81. This dramatic sell-off has erased roughly $57 billion in market capitalization, a figure that vividly illustrates the fallout from the company’s inability to stabilize its financial reporting. The past week has been particularly devastating for Super Micro, culminating in its worst market performance to date following the resignation of its auditor, Ernst & Young, the second accounting firm to abandon the company in just two years.

The company’s troubles are compounded by allegations of accounting irregularities and accusations of exporting sensitive chips to nations under U.S. sanctions, which have raised serious concerns about the firm’s adherence to export control regulations. In an environment already rife with skepticism, Super Micro’s failure to file audited financials since May has exacerbated its predicament. The looming threat of delisting from Nasdaq adds yet another layer of urgency to the company’s situation, especially as the deadline for filing the latest fiscal results approaches in mid-November.

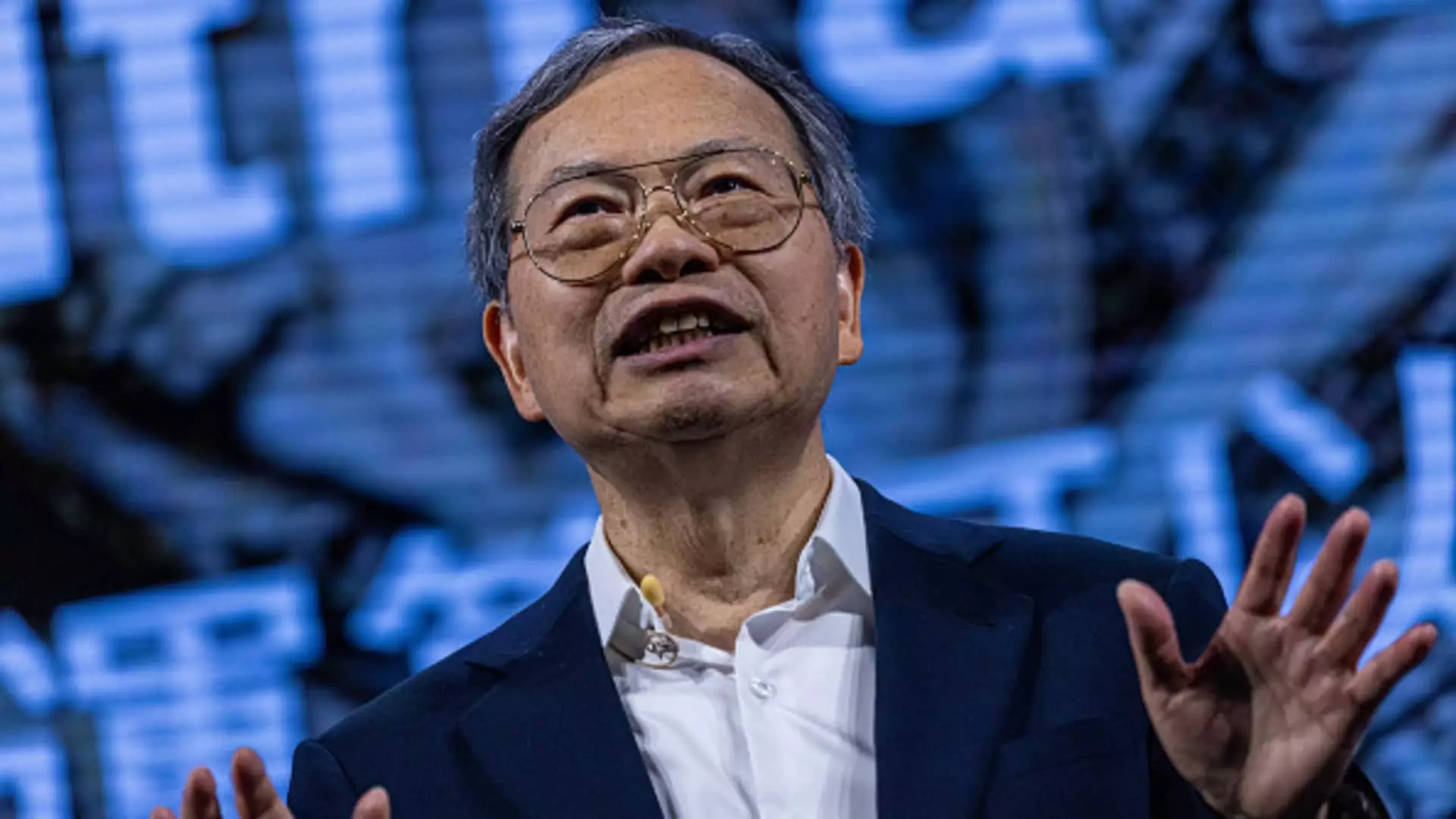

During a recent call with financial analysts, the company’s leadership refrained from providing substantial answers to pressing questions concerning Ernst & Young’s resignation and the corporate governance issues associated with these developments. CEO Charles Liang acknowledged the ongoing efforts to secure a new auditor but fell short of delivering a concrete timeline for restoring the company’s financial reporting to acceptable standards.

Analysts have reacted with skepticism, with Mizuho suspending coverage of Super Micro’s stock due to the lack of detailed and audited financial disclosures. Similarly, Wedbush analysts expressed concern, suggesting that the current management strategy appears too focused on resolving audit issues rather than addressing the broader implications for the company’s financial health.

Despite these setbacks, Super Micro has reported remarkable sales figures, generating net sales between $5.9 billion and $6 billion for the quarter ending September 30. While this performance may seem impressive, particularly as it reflects a staggering 181% increase year-over-year, it falls short of analysts’ expectations, which had projected sales of approximately $6.45 billion.

The company’s rapid growth can largely be attributed to its role in shipping servers equipped with Nvidia’s advanced AI processors, specifically the Nvidia GPU known as Blackwell. Following a strong demand trajectory, Super Micro’s stocks had soared by 246% last year, illustrating a volatility that makes their current circumstance feel all the more critical. Analysts have eagerly posed questions about the timing and financial impact of the Blackwell shipments, emphasizing the need for clarity in forecasts moving forward.

Looking Ahead: A Clouded Future

While Super Micro’s recent performance data reflects a burgeoning business in the artificial intelligence sector, the forecast for the December quarter has also left something to be desired. The company has indicated revenue expectations falling between $5.5 billion and $6.1 billion, significantly lower than the $6.86 billion average estimated by analysts. Expectations for adjusted earnings per share have similarly been revised downwards, signaling a growing concern about overall profitability as the company grapples with its ongoing issues.

In response to the internal complaints raised by Ernst & Young, Super Micro has commissioned a special committee to investigate the accountant’s concerns. Following a three-month review, the committee reportedly found no evidence of fraud or management misconduct, a statement that may serve to mitigate fears but does little to alleviate investor anxiety in the short term.

As Super Micro navigates this challenging landscape, its future hinges on clearer communication, restored financial stability, and a resolute commitment to regulatory compliance. How effectively the company manages these challenges will ultimately determine its ability to regain investor trust and stabilize its share price in the increasingly competitive and rapidly evolving tech market.

Leave a Reply