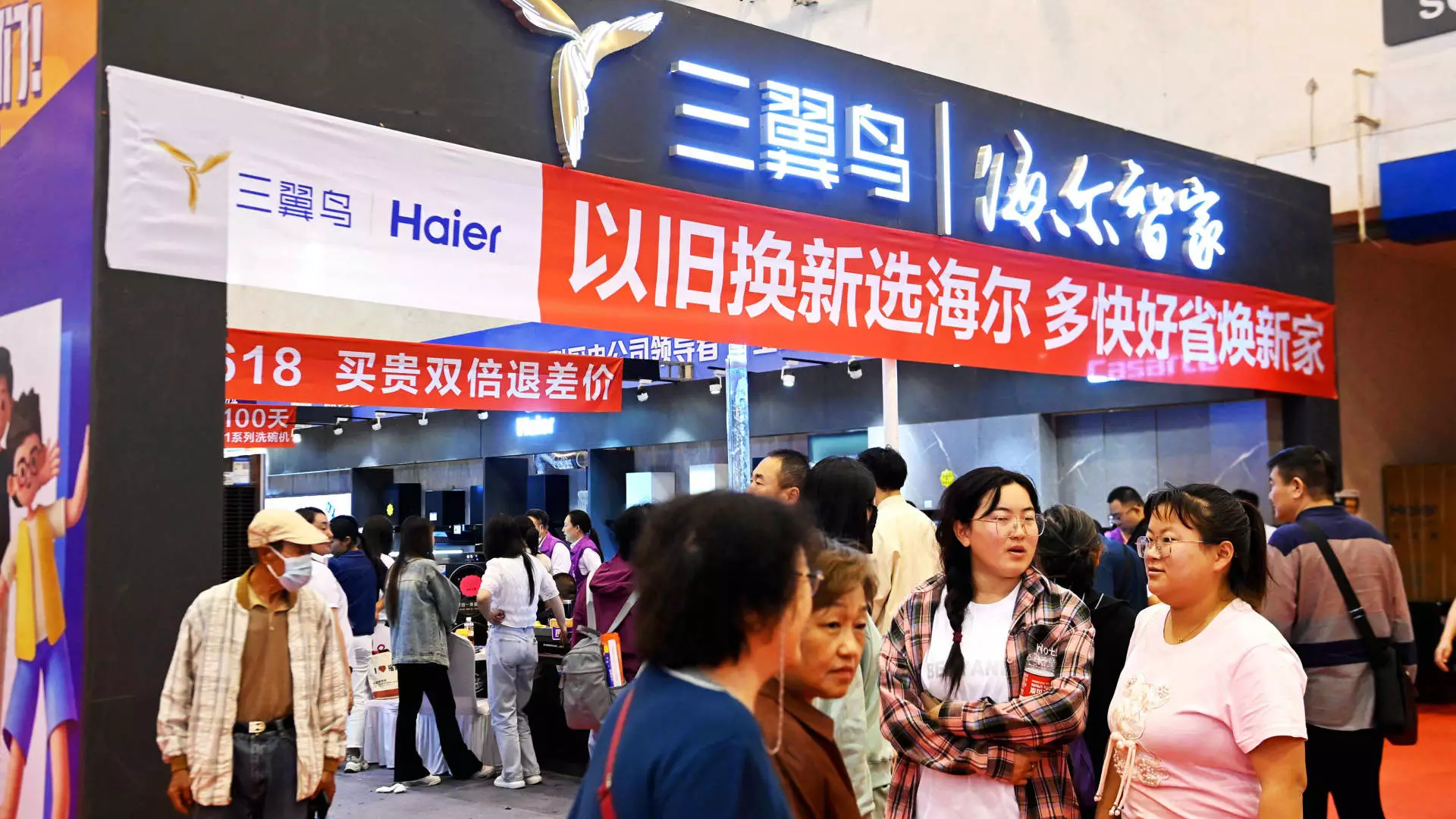

In the wake of economic uncertainty, China’s government has unveiled a significant plan to stimulate consumption via a trade-in policy aimed at upgrading consumer products and equipment. Announced in July, this initiative is underpinned by the allocation of 300 billion yuan (approximately $41.5 billion) in ultra-long special government bonds. This article dissects the measures, explores the initial reception from businesses, and examines the broader implications for China’s retail landscape.

At the heart of this trade-in initiative lies the hope that a financial boost will catalyze higher consumer spending. Of the allocated funds, 150 billion yuan is aimed at subsidizing trade-ins for consumer goods like vehicles and home appliances, while the remaining half targets the upgrade of large-scale equipment, such as elevators. Despite these ambitious plans, reports from several businesses suggest that the initiative’s impact has yet to materialize in any meaningful way.

Jens Eskelund, president of the EU Chamber of Commerce in China, expressed skepticism regarding the execution of the policy. According to him, there has been minimal evidence that the translated measures lead to tangible benefits on the ground. Such concerns raise serious questions about the efficacy of government policies that require consumers to invest upfront and possess an older item for trade-in. With such barriers, the likelihood of significantly boosting consumption seems dim.

A report published by the Chamber of Commerce highlighted that the effective budget per capita, based on the announced amount, is around 210 yuan ($29.50). This figure is particularly concerning when considering that only a fraction of this budget is expected to reach end consumers. Consequently, analysts caution that this trade-in scheme, while being a step in the right direction, is unlikely to yield a substantial increase in domestic consumption.

UBS’s Chief China Economist, Tao Wang, projected that the new trade-in policy might only support a marginal 0.3% of retail sales in 2023, a figure that may not sway the significantly slowing retail landscape in China. Recent sales data underscores this decline; June saw a mere 2% rise in retail sales—the slowest since the pandemic—while July offered a mild improvement at 2.7%.

Sector-Specific Reactions and Outlooks

The cut in government subsidies for new energy and conventional fuel-powered vehicle purchases has resulted in a notable uptick, indicating sectors that adapt quickly can benefit from policy shifts. However, responses from foreign elevator manufacturers highlight a disconnect between policy intent and ground-level reality. Companies such as Otis reported a significant drop in equipment sales and maintain that clarity on fund allocations is still lacking. This absence of defined guidance creates obstacles for businesses hoping to capitalize on the available financial resources.

On a more positive note, global elevator maker Kone acknowledged future opportunities despite their own revenue slump in Greater China. Their CFO, Ilkka Hara, emphasized the potential for energy-saving innovations in new elevators as a long-term sales strategy. Despite ongoing struggles, he remains hopeful about the significant opportunities the trade-in initiative could trigger, even if its full impact remains uncertain.

Long-term Implications for Secondhand Markets

While the immediate effects of the trade-in program appear limited, there is an optimistic perspective within specific sectors, particularly for businesses like ATRenew. This company, specializing in secondhand goods, indicates that while short-term effects are minimal, the program supports the established development of the secondhand market—a component that gains prominence in consumer behavior.

Interestingly, ATRenew noted a surge in trade-in orders, particularly for mobile devices and laptops. They reported a year-on-year increase of over 50% in trade-in volume on e-commerce platforms such as JD.com following the implementation of the policy. This illustrates that, while the overarching trade-in initiative may be struggling, certain categories might witness a more robust demand.

China’s policy to stimulate consumption through trade-ins represents a bold but nuanced approach to revitalize its economy amid turbulent times. However, the challenge remains in the execution, clarity, and ultimately, the tangible results of these initiatives. As companies evaluate the ramifications of these policies, it is apparent that a coordinated effort across all levels—from local governments to consumers—is essential to unlock the potential benefits of trade-in subsidies. Until then, many remain skeptical about the actualization of the intended economic revival, making it imperative for the Chinese government to focus on transparency and effective deployment of resources.

Leave a Reply