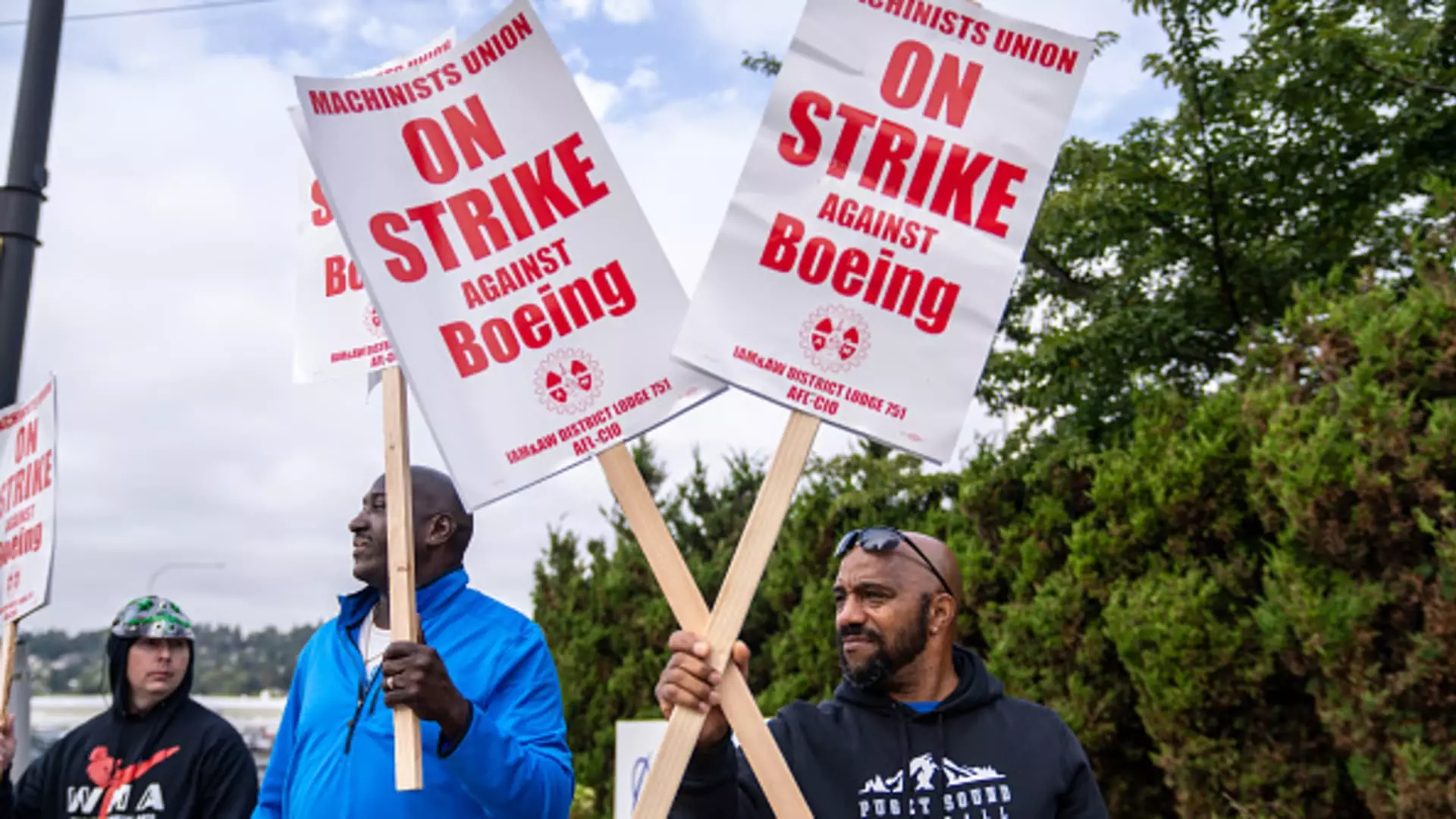

The ongoing labor strike at Boeing has plunged the aircraft manufacturer into a dual crisis of operational and financial distress. Over a month ago, the turbulence began when more than 30,000 machinists – part of the International Association of Machinists and Aerospace Workers – walked off their jobs after rejecting a tentative employment contract. This massive mobilization not only highlights worker dissatisfaction but presents a significant challenge for Kelly Ortberg, Boeing’s new CEO, who was appointed amid a backdrop of ongoing crisis management. As the strike extends, the financial ramifications appear dire, and the path to resolution remains clouded in uncertainty.

Boeing finds itself in a precarious position, with S&P Global Ratings estimating a monthly loss of over $1 billion due to halted operations triggered by the strike. This figure compounds an already difficult fiscal year for the aviation giant, which suffered significant operational hiccups starting with a critical door malfunction in their 737 Max model. These operational issues are compounded by the aftermath of two catastrophic crashes that left the company struggling for stability. Adding to the complexity, a recent attempt to renegotiate with striking workers has not yielded positive results, demonstrating the significant divide between labor demands and executive willingness to negotiate effectively.

The company’s recent withdrawal of a revised contract proposal, which came after an initial proposal was overwhelmingly rejected, signals a troubling lack of understanding of labor relations dynamics. Experts, such as Harry Katz from Cornell, argue that Boeing will need to bolster its offerings significantly to cultivate goodwill among workers. While some of the union’s wishes, such as restoring a pension plan, may not be met, it is evident that any successful negotiation will require a shift in approach from Boeing—a shift that may be lacking under the current management.

Amidst the increasing challenges arising from this stalemate, negotiation channels have been strained further. The breakdown of federally mediated efforts suggests a growing rift between the union and the company. Boeing has gone so far as to file a complaint with the National Labor Relations Board, claiming bad faith negotiations on behalf of the union. This dispute only adds to the mounting difficulties for Ortberg, whose ability to foster positive labor relations is being sharply scrutinized.

The call for a return to negotiations by union leader Jon Holden illustrates the frustration felt at the grassroots level. Workers are facing the harsh realities of lost income and diminishing benefits, prompting a sense of urgency in seeking a resolution. Unlike previous strikes, such as the one in 2008, current market conditions present more opportunities for displaced workers to find temporary employment in other sectors. However, the fundamental issues underlying the strike go far beyond immediate financial concerns; they reflect a deeper dissatisfaction with corporate practices and a longing for a more equitable negotiation process.

In tandem with the labor issues, Boeing is grappling with pressing strategic decisions that have drawn investor skepticism. The announcement of a 10% workforce cut underscores the desperation of a company that has not reported annual profits since 2018. As losses deepen, executives are now faced with the revelation that production schedules for key aircraft, like the 777X, will be delayed further, painting a bleak picture for future profitability.

Analysts observe that the relationship between labor and management could dictate Boeing’s trajectory moving forward. Richard Aboulafia highlights a contradiction in Boeing’s strategy; the company seems to be letting go of critical personnel that could stabilize production processes while simultaneously facing chronic cash flow challenges. This irony poses a significant risk to the long-term viability of one of America’s most iconic manufacturers.

Boeing’s upheaval resonates far beyond its own operations, affecting suppliers and the broader aerospace ecosystem. Companies like Spirit AeroSystems, responsible for producing crucial components for Boeing’s jets, are contemplating furloughs of their own employees amid fears of cascading impacts from Boeing’s financial instability. The entire supply chain is precariously linked to Boeing’s fate, suggesting that the ramifications of the strike and poor management might ripple throughout the sector.

The challenges faced by Boeing are emblematic of larger issues inherent in labor relations, corporate governance, and the aerospace industry itself. As Ortberg prepares for his first earnings call as CEO, he is positioned at a crucial juncture where decisions made now could have far-reaching implications. The coming weeks and months will be pivotal for Boeing, as the company must address internal rifts, renegotiate labor contracts, and stabilize its operations in an industry burdened by uncertainty. Only time will reveal whether Boeing can turn its fortunes around amidst an environment of heightened tensions and financial duress.

Leave a Reply