The recent performance of U.S. stocks has seen a rebound after a three-day losing streak, with the S & P 500 climbing 1.5%, the Dow Jones Industrial Average rising by 1%, and the Nasdaq Composite jumping by 1.9%. Jim Cramer, of the CNBC Investing Club, described the day as a positive one following a previous decline, attributing the sell-off to the unwinding of the “yen carry trade” and concerns over a U.S. recession sparked by disappointing jobs report. The market volatility experienced serves as a reminder of the unpredictable nature of stock performance and the need for investors to stay informed and cautious.

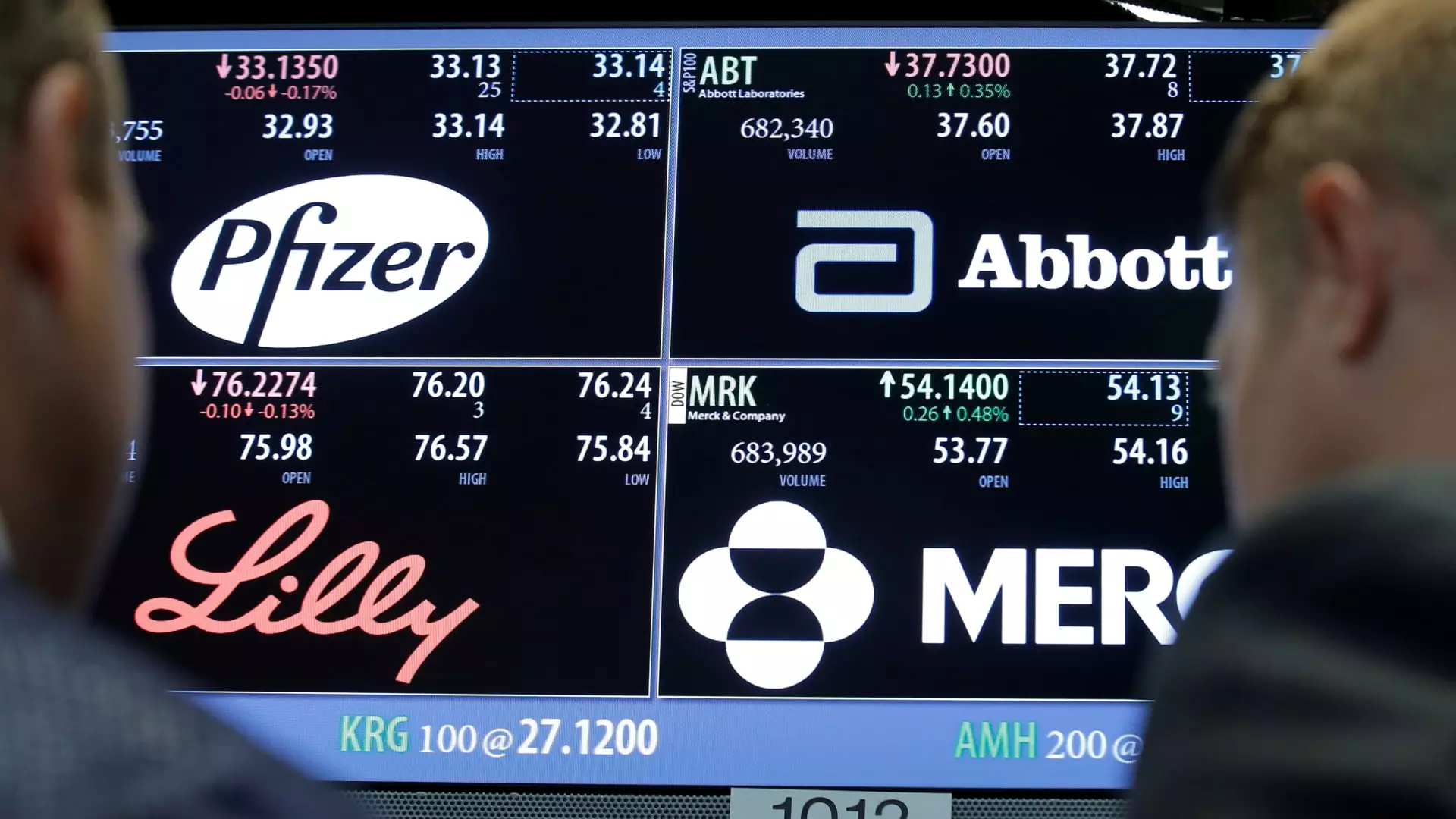

One of the key trends affecting stock performance is the disappointing earnings results of pharmaceutical companies like Eli Lilly. Shares declined by 1.7% following Novo Nordisk’s weak earnings report, which showed lower-than-expected net profit and sales of its weight-loss drug Wegovy. As investors speculate on the impact on Eli Lilly’s GLP-1 drugs Zepbound and Mounjaro, it is clear that market sentiment towards pharmaceutical stocks remains uncertain. With heightened competition and changing consumer preferences, companies in this sector face challenges in maintaining profitability and market share.

On a more positive note, Amazon received a boost in its e-commerce business following CVS Health’s announcement of retail store closures. CVS Health’s restructuring efforts, which include shutting down 900 retail drug stores by year-end, create an opportunity for Amazon to capture more market share in the shipping of essential items. This development reflects the shifting dynamics in the retail industry, with consumers increasingly turning to online platforms for convenience and accessibility. Amazon’s shares surged by almost 3% in response to this news, demonstrating the potential for growth in the e-commerce sector.

Strategic Investment Insights from CNBC Investing Club

Subscribers to the CNBC Investing Club with Jim Cramer gain access to valuable trade alerts and insights before major trading decisions are made. Jim Cramer follows a disciplined approach to trading, waiting 45 minutes after sending a trade alert before executing transactions in his charitable trust’s portfolio. Additionally, if a stock is discussed on CNBC TV, a 72-hour waiting period is observed before any trades are made. This cautious approach reflects the importance of thorough research and analysis in making informed investment decisions in a volatile market environment.

Recent market trends have highlighted the need for investors to stay vigilant and adaptable in response to changing economic conditions and industry dynamics. The impact of factors such as global trade tensions, economic data releases, and corporate earnings reports can create volatility in stock prices and investor sentiment. By staying informed, diversifying portfolios, and following a disciplined investment strategy, investors can navigate through market uncertainties and capitalize on new opportunities for growth.

Leave a Reply