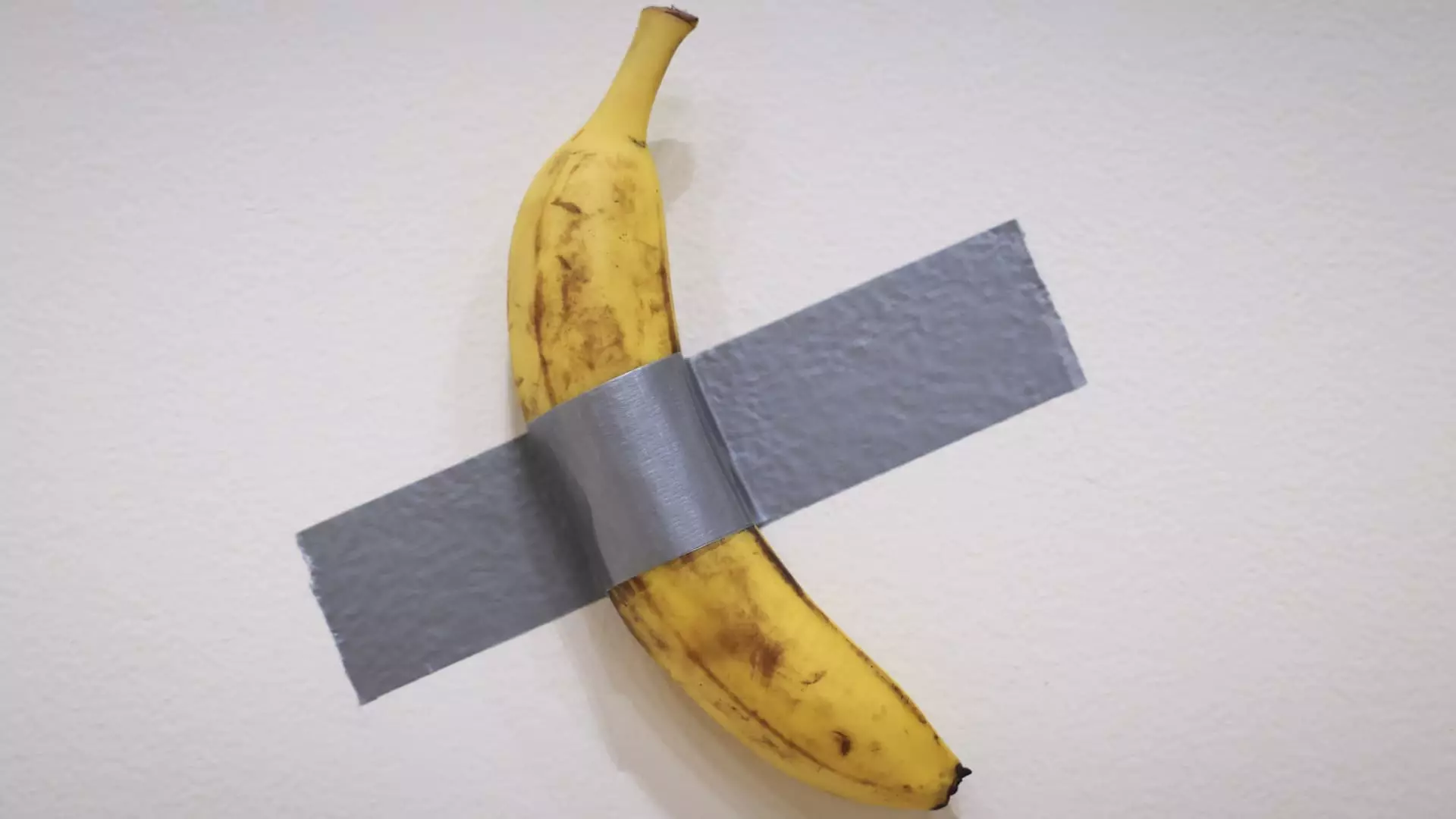

In the ever-evolving landscape of contemporary art, one event has sparked both fascination and debate: the sale of a banana duct-taped to a wall for a staggering $6.2 million. This audacious piece, aptly named “Comedian,” was created by Maurizio Cattelan, an artist renowned for his provocative works that often challenge societal norms. At the heart of this sale lies not only the dollar figure but also the cultural dialogue surrounding the merging realms of art, social media, and cryptocurrency. The transaction, carried out by prominent crypto investor Justin Sun, serves as a vivid example of how art can transcend its physical form and embody cultural significance.

“Comedian” initially made headlines not just for its price but also for the viral attention it garnered. Its debut at Art Basel Miami Beach in 2019 attracted enormous crowds, demonstrating how artworks can thrive in the digital age through memes and social media exposure. The banana’s image quickly circulated online, transforming it into a commentary on consumerism and the absurdity of modern art valuation. Sun’s investment highlights the shift in how we perceive art; where once the intrinsic value of an artwork was tied solely to the artist’s reputation or craftsmanship, it now also hinges on its virality and media buzz.

The rampant proliferation of information on social platforms can amplify an artwork’s status, morphing it into an icon mere moments after its inception. By bidding such a significant amount for a piece that many might consider irreverent, Sun seemingly embraces this intersection of art and contemporary culture, pushing societal boundaries to build a new framework for understanding value.

Justin Sun’s choice to purchase “Comedian” with cryptocurrency essentially mirrors the ongoing innovation in the financial world. As digital assets become more commonplace and accepted, the recognition of cryptocurrency as a serious form of payment raises questions about traditional asset valuation. The seller’s acceptance of crypto wasn’t arbitrary; it signified a growing acknowledgment of this currency’s legitimacy in high-value transactions. The art world, long seen as resistant to change, is now opening its doors to this new financial paradigm.

The irony, however, lies in the fact that the banana itself—an organic and perishable item—is merely a fleeting element within the larger context of the work. The true value of “Comedian” is attached to the accompanying certificate of authenticity from the artist, a notion reminiscent of non-fungible tokens (NFTs), where ownership is based on proof rather than the physical object itself. Sun’s reference to eating the banana as a unique artistic experience reinforces the notion that the essence of the piece transcends its materiality.

This sale occurred in the backdrop of a resurgent art market, buoyed by a stable economic climate and increased confidence among affluent collectors following turbulent economic periods. Just days before, renowned auction houses had achieved remarkable sales, such as a Monet work that fetched $65.5 million. The success of these auctions, juxtaposed against Sun’s outrageous banana purchase, signals a potential renaissance in art investment, drawing in a demographic increasingly interested in the blend of traditional art and technological advancements.

As we move forward, the implications of such transactions suggest a pivotal shift in the art world and its relationship with value, ownership, and cultural commentary. “Comedian” stands as a marker of this transformation—one that invites audiences to reconsider what constitutes art, who gets to define its value, and how financial markets can engage in discussions that were once reserved for more conventional auctions.

The sale of “Comedian” for $6.2 million is emblematic of the evolving discourse in modern art, revealing how cultural context, social media, and technological advancements coalesce to redefine value. Justin Sun’s purchase is not merely a whimsical expression of wealth; it represents a profound engagement with how art interacts with contemporary society. As the art world navigates this intricate landscape, we can only anticipate what groundbreaking pieces will emerge next, continuing to blur the lines between asset and experience, culture and commerce.

Leave a Reply